2024-2025 Choices Retiree Workbook

Retiree Benefits 2024-2025

Montana University System

• If you want to make changes to your Montana University System (MUS) Choices Retiree Benefit Plan (MUS Plan) coverage for the upcoming Plan Year, contact your

campus Benefits Representative for a Retiree Enrollment Form and submit the completed

form to your campus HR/Benefits office by May 15, 2024.

• If you are not making any changes to your MUS Plan coverage for the upcoming Plan

Year, you do not need to submit a Retiree Enrollment Form and will automatically be

re-enrolled in your current benefit elections and coverage levels.

MUS retirees who pay their monthly premium payments via Direct Bill will continue

to submit their payments directly to Businessolver for the upcoming Plan Year. Businessolver

offers online payments (accessed from the MUS Choices home page), scheduled automated clearing house (ACH) transactions, or monthly billing statements.

MUS retirees who pay their monthly premium payments via the Montana Teachers’ Retirement

System (TRS) or the Montana Public Employees’ Retirement System (PERS) will continue

to have their monthly premiums automatically deducted from their pension plan for

the upcoming Plan Year. If you need to change your premium payments from a pension

plan deduction to Direct Bill as of July 1, 2024, please contact your Campus Benefits Representative to assist you with this change.

Table of Contents

Table of Contents

- Campus Human Resources/Benefit Office Contacts

- Enrolling as a Retiree

- Retiree Rates

- Medical Plan Costs

- Schedule of Medical Benefits

- Preventive Services

- Prescription Drug Plan

- Dental Plan

- Vision Hardware Plan

- MUS Wellness Program

- Additional Benefit Plan Information

- Glossary

- Insurance Card Examples

- Resources

Campus Human Resources/Benefits Office Contacts

MSU - Bozeman

920 Technology Blvd, Ste. A

Bozeman, MT 59717

406-994-3651

MSU - Billings

1500 University Dr.

Billings, MT 59101

406-657-2278

MSU - Northern

300 West 11th Street

Havre, MT 59501

406-265-3568

Great Falls College - MSU

2100 16th Ave. S.

Great Falls, MT 59405

406-268-3701

UM - Missoula

32 Campus Drive

Lommasson, Room 252

Missoula, MT 59812

406-243-6766

Helena College - UM

1115 N. Roberts

Helena MT 59601

406-447-6925

UM - Western

710 S. Atlantic St.

Dillon, MT 59725

406-683-7010

MT Tech - UM

1300 W. Park St.

Butte, MT 59701

406-496-4380

OCHE, MUS Benefits Office

560 N. Park Ave

Helena, MT 59620

877-501-1722

Dawson Community College

300 College Dr.

Glendive, MT 59330

406-377-9430

Flathead Valley Community College

777 Grandview Dr.

Kalispell, MT 59901

406-756-3981

2715 Dickinson St.

Miles City, MT 59301

406-874-6292

Choices Enrollment for a Retiree

Benefit Plan Year July 1 - June 30

To enroll in MUS Plan coverages as a Retiree, you must complete and return a Retiree Enrollment Form to your campus HR/Benefits office:

- within 63 days of retirement and becoming eligible for Retiree benefits. If you do not enroll within the 63-day enrollment period, you will permanently forfeit

your eligibility for all MUS Retiree Plan coverages.

- during Annual Enrollment by the stated deadline. If you do not make any benefit changes, you will automatically be enrolled in your current benefit elections and coverage levels or to the stated

default coverage if your existing plan(s) is/are changing.

- when you have a mid-year qualifying event (marriage, birth or adoption of a child, loss or gain of eligibility for other health insurance coverage) and want to make an allowed mid-year change in benefit elections. This change must be made within 63 days of the event. Documentation to support the change will be required.

Voluntarily canceling other health insurance does not constitute loss of eligibility.

MEDICARE ENROLLMENT: Retirees and/or their covered dependents who are or become Medicare-eligible (age

65) at retirement or after, must be enrolled in BOTH Medicare Part A and Medicare Part B. If Medicare enrollment is not completed within

63 days from the date of retirement or the retiree’s and/or covered dependent’s Medicare

eligibility date, the individual(s) will be disenrolled from the MUS Medical and Prescription

Drug Plans. Enrollment in the Select Dental Plan and/or Vision Hardware Plan may be

continued if the Medicare-eligible Retiree and/or covered dependent is enrolled in

those plans at retirement or date of Medicare eligibility, even if they are disenrolled

from the MUS Medical and Prescription Drug Plans due to not enrolling in Medicare

Part A and Part B.

No Retreat Rights:

If you waive MUS Retiree Medical, Dental, and/or Vision Hardware Plan coverage(s), you and your eligible dependents will permanently forfeit your coverage(s) and will NOT be allowed to enroll in the future.

If you are waiving coverage for your eligible dependents because they are currently covered by another health insurance plan, you may be able to enroll your eligible dependents for coverage under the MUS Plan in the future, provided you request such coverage within 63 days after their other coverage ends due to a qualifying event (as defined by the MUS SPD).

If you acquire an eligible dependent due to a qualifying event (as defined by the MUS SPD), you may enroll your newly acquired eligible dependent for coverage under the MUS Plan, provided that such enrollment occurs within 63 days of the event.

Reminder: MUS has Closed Enrollment for a legal spouse, unless there is a qualifying event (see SPD for qualifying events).

Step-by-Step Process for Completing Your Choices Retiree Enrollment Form

Step 1: Review this workbook carefully and read the back of the Retiree Enrollment Form

- Discuss this information with your legal spouse and/or other family members.

- Determine your benefit needs for the coming benefit Plan Year if you are making benefit changes for Annual Enrollment or for the remainder of the current benefit Plan Year if a new Retiree.

- This enrollment workbook is not a guarantee of benefits.

Enrollment in Retiree coverage is a one-time opportunity.

Step 2: Complete your Retiree Enrollment Form.

Submit your completed enrollment form to your campus HR/Benefits Office.

Medical Plan Coverage (includes Prescription Drug Plan)

For Medical Plan coverage, you must be qualified to enroll (see back of enrollment form). If you do not make an election to continue your Medical Plan coverage when you first retire, you will permanently forfeit your Medical Plan coverage.

- Choose the coverage level you want.

- Once you have selected a coverage level, fill in the corresponding monthly premium amount in the space provided on the enrollment form, by “Medical Premium”.

- or check the box that declines Medical Plan coverage entirely.

Medicare Part D Prescription Drug Plan Coverage

- Medicare primary Retiree Medical Plan enrollees will automatically be enrolled in the Navitus MedicareRx (Part D) Plan.

- If you opt out of the Navitus MedicareRx Plan or get another Medicare Part D plan, you will forfeit your Medical Plan coverage.

Dental Plan Coverage

For Dental Plan coverage, you must be qualified to enroll (see back of enrollment form). Retirees are offered enrollment in the Select Dental Plan only. If you do not make an election to continue your Dental Plan coverage when you first retire, you will permanently forfeit your Dental Plan coverage.

- Choose the coverage level you want.

- Once you have selected a coverage level, fill in the corresponding monthly premium amount in the space provided on the enrollment form, by “Dental Premium”.

- or check the box that declines Dental Plan coverage entirely.

Vision Hardware Plan Coverage

For Vision Hardware Plan coverage, you must be qualified to enroll (see back of enrollment form). You cannot enroll in Vision Hardware Plan coverage as a retiree if you were not enrolled in coverage prior to retirement. If you do not make an election to continue your Vision Hardware Plan coverage when you first retire, you will permanently forfeit your Vision Hardware Plan coverage.

- Choose the coverage level you want.

- Once you have selected a coverage level, fill in the corresponding monthly premium amount in the space provided on the enrollment form, by “Vision Premium”.

- or check the box that declines Vision Hardware Plan coverage entirely.

Step 3: Total Your Costs:

- Add up the total monthly premium amounts and fill in the corresponding monthly premium amount in the space provided on the enrollment form, by “Total Monthly Premium”.

- Arrange with your campus Benefits Representative for automatic payment of your premiums through your pension plan or a direct bill payment account.

Step 4: Demographic and Dependent Coverage.

Please complete these sections each time you fill out the Retiree Enrollment Form. If you have questions, consult your Choices workbook, SPD, or contact your campus Benefits Representative.

How the Choices Medical Plan Works

When a Plan member receives covered medical services from an In-Network Provider, the provider will submit a claim to the Plan claims administrator for the member. The Plan claims administrator will process the claim and send an Explanation of Benefits (EOB) to the member and the provider, showing the member’s payment responsibility (deductible, copayments, and/or coinsurance costs). The Plan then pays the remaining allowed amount for covered services. The provider will not balance bill the member the difference between the billed charge and the allowed amount for covered services.

When a Plan member receives covered medical services from an Out-of-Network Provider, the member must verify if the provider will submit the claim to the Plan claims administrator or if the member must submit the claim. The Plan claims administrator will process the claim and send an EOB to the member showing the member’s payment responsibility (deductible, coinsurance, and any difference between the allowed amount (balance billing)). The Plan pays the remaining allowed amount for covered services. The Out-of-Network Provider may balance bill the member the difference between the billed charge and the allowed amount.

Members may self-refer to any health care provider, however, there is a cost savings for covered medical services received by an In-Network Provider.

Definition of Terms

In-Network Providers – Providers who have contracted with the Plan claims administrator to manage and deliver care at agreed upon allowed amounts. You pay a $30 copayment for Primary Care Physician (PCP) office visits and a $50 copayment for Specialist office visits to In-Network Providers (no deductible) and 30% coinsurance (after deductible) for covered In-Network outpatient/inpatient services.

Out-of-Network Providers – Providers who do not have a contract with the Plan claims administrator. You pay 40% of the allowed amount (after a separate deductible) for covered services received from an Out-of-Network Provider.

Out-of-Network Providers may balance bill you for any difference between their billed charge and the allowed amount for covered services.

Emergency Services – Emergency services are covered everywhere; however, Out-of-Network Providers may balance bill the difference between the allowed amount and the billed charge for covered services.

Deductible – The amount you pay each benefit Plan Year before the Plan begins to pay for covered services.

Copayment - A fixed dollar amount the member pays for a covered service, usually at the time the member receives the service. The Plan pays the remaining allowed amount for covered services.

Coinsurance – A percentage of the allowed amount for covered services you pay, after paying any applicable deductible.

Out-of-Pocket Maximum - The maximum amount you pay toward the cost of covered services. Out-of-Pocket expenses for covered services include deductibles, copayments, and coinsurance.

Important: Verify the network status of your providers. This is an integral cost savings component of each of your plan choices.

Medical Plan (optional)

Medical Plan (optional)

Administered by BlueCross BlueShield of Montana

1-800-820-1674 or 1-406-447-8747

Choices offers a Medical Plan for Retirees and their eligible dependents.

Continuation of enrollment in the Medical Plan is a one-time opportunity for Retirees (and their eligible dependents) at retirement. Coverage is permanently forfeited if the Retiree fails to continue enrollment, cancels Medical coverage, or fails to pay premiums. Note: A legal spouse reaching age 65 is not a qualifying event for re-enrolling in Medical coverage.

| Monthly Medical Plan Rates | |

|---|---|

| Non-Medicare Retiree/Survivor Only | $981 |

| Non-Medicare Retiree + 1 Non-Medicare Dependent | $1,962 |

| Non-Medicare Retiree + 2 or more Non-Medicare Dependents | $2,452 |

| Non-Medicare Retiree + 1 Medicare Dependent | $1,354 |

| Non-Medicare Retiree + Medicare Spouse + Child(ren) | $1,845 |

| Non-Medicare Survivor + Child(ren) | $1,471 |

| Monthly Medical Plan Rates | |

|---|---|

| Medicare Retiree/Survivor Only | $368 |

| Medicare Retiree + 1 Non-Medicare Dependent | $1,354 |

| Medicare Retiree + 2 or more Non-Medicare Dependents | $1,845 |

| Medicare Retiree + 1 Medicare Dependent | $736 |

| Medicare Retiree + Medicare Spouse + Child(ren) | $1,219 |

| Medicare Retiree Survivor + Child(ren) |

$851 |

Schedule of Medical Benefits

|

In-Network |

Out-of-Network * |

|

|---|---|---|

| Deductible Applies to all covered services, unless otherwise noted or copayment is indicated. |

$1,250/Person $2,500/Family |

Separate $2,500/Person Separate $5,000/Family |

| Copayment (outpatient office visits) Primary Care Physician Visit (PCP) Specialist Provider Visit |

$50 copay |

N/A |

| Coinsurance Percentage (% of allowed charges member pays) |

30% | 40% |

|

Out-of-Pocket Maximum (Maximum amount paid by member in a Plan Year for covered services; includes deductibles, copays, and coinsurance) |

$4,350/Person $8,700/Family |

Separate $6,000/Person Separate $12,000/Family |

*Services from an Out-of-Network Provider have separate deductibles, % coinsurance, and Out-of-Pocket maximums.

An Out-of-Network Provider may balance bill the difference between their billed charge and the allowed amount for covered services.

Examples of Medical Costs to Plan and Member - Primary Care Physician Visit

Benefit Plan Year July 1 – June 30

(In-Network)

Jack’s Plan deductible is $1,250, coinsurance is 30%, and out-of-pocket max is $4,350.

Jack has not reached his deductible yet and he visits the doctor and has lab work. He pays $30 for the office visit and 100% of the allowed amount for covered lab charges. For example, Jack’s doctor visit totals $1,000. The office visit is $150 and lab work is $850. The Plan allows $100 for the office visit and $400 for the lab work. Jack pays $30 for the office visit and $400 for the lab work. The Plan pays $70 for the office visit and $0 for the lab work. The In-Network Provider writes off $500.

Jack has seen the doctor several times and reaches his $1,250 deductible. He pays $30 for the office visit and 30% of the allowed amount for lab work and the Plan pays the remainder of the office visit + 70% of the allowed amount. For example, Jack’s doctor visit totals $1,000. The office visit is $150 and lab work is $850. The Plan allows $100 for the office visit and $400 for the lab work. Jack pays $30 for the office visit and $120 for the lab work. The Plan pays $70 for the office visit and $280 for the lab work. The In-Network Provider writes off $500.

Jack reaches his $4,350 out-of-pocket maximum. Jack has seen his doctor often and paid $4,350 total (deductible + coinsurance + copays). The Plan pays 100% of the allowed amount for covered services for the remainder of the Plan Year. For example, Jack’s doctor visit totals $1,000. The office visit is $150 and lab work is $850. The Plan allows $100 for the office visit and $400 for the lab work. Jack pays $0 and the Plan pays $500. The In-Network Provider writes off $500.

(Out-of-Network)

Jack’s Plan deductible is $2,500, coinsurance is 40%, and out-of-pocket max is $6,000.

Jack hasn't reached his deductible yet and he visits the doctor. He pays 100% of the provider charge. Only allowed amounts apply to his deductible. For example, the provider charges $1,000. The Plan allowed amount is $500. $500 applies to Jack’s Out-of-Network deductible. Jack must pay the provider the full $1,000.

Jack has seen the doctor several times and reaches his $2,500 deductible. His Plan pays some of the costs of his next visit. He pays 40% of the allowed amount and any difference between the provider charge and the Plan allowed amount. The Plan pays 60% of the allowed amount. For example, the provider charges $1,000. The Plan allowed amount is $500. Jack pays 40% of the allowed amount ($200) + the difference between the provider charge and the Plan allowed amount ($500). Jack’s total responsibility is $700. The Plan pays 60% of the allowed amount ($300).

Jack reaches his $6,000 out-of-pocket maximum. Jack has seen his doctor often and paid $6,000 total (deductible + coinsurance). The Plan pays 100% of the allowed amount for covered services for the remainder of the Plan Year. Jack pays the difference between the provider charge and the allowed amount. For example, the provider charges $1,000. The Plan allowed amount is $500. Jack pays $500 and the Plan pays $500.

| Services | In-Network | Out-of-Network |

|---|---|---|

| Hospital Inpatient Services Pre-Certification of non-emergency inpatient hospitalization is recommended | ||

| Room & Board Charges | 30% | 40% |

| Ancillary Services | 30% | 40% |

|

Surgical Services (See SPD for surgeries requiring prior authorization) |

30% | 40% |

| Hospital Outpatient Services | ||

| Outpatient Services | 30% | 40% |

| Outpatient Surgery Center Services | 30% | 40% |

| Physician/Professional Provider Services (not listed elsewhere) | ||

|

Primary Care Physician (PCP) Office Visit - Includes Telemedicine and Naturopathic visits Note: Naturopathic visits are processed In-Network, however, the member may be balance billed the difference between the billed charge and the allowed amount. |

$30 copay/visit (for office visit only - lab, x-ray & other services subject to deductible/coinsurance) |

40% |

|

Specialist Office Visit - Includes Telemedicine visits |

$50 copay/visit (for office visit only - lab, x-ray & other services subject to deductible/coinsurance) |

40% |

| Inpatient/Outpatient Physician Services | 30% | 40% |

| Lab/Ancillary/Misc. Services | 30% | 40% |

| Eye Exam (preventive or medical) |

0% (no deductible) one/Plan Year (additional exams subject to office visit copay) |

40% |

| Hearing Exam (preventive or medical) |

0% (no deductible) one/Plan Year (additional exams subject to office visit copay) |

40% |

| Second Surgical Opinion |

0%/visit (no deductible) (for office visit only - lab, x-ray & other services subject to deductible/coinsurance) |

40% |

| Emergency Services Note: Emergency Services are processed In-Network | ||

| Ambulance Services for Medical Emergency (ground or air) |

$200 copay/transport (for transport only - other services & supplies are subject to deductible/coinsurance) |

$200 copay/transport (for transport only - other services & supplies are subject to deductible/coinsurance) |

| Emergency Room Charges |

$250 copay/visit (for room charges only - lab, x-ray & other services subject to deductible/coinsurance (waived if immediately admitted to hospital)) |

$250 copay/visit (for room charges only - lab, x-ray & other services subject to deductible/coinsurance (waived if immediately admitted to hospital)) |

| Professional Provider Services | 30% | 30% |

| Urgent Care Services Note: Urgent Care Services are processed In-Network | ||

| Facility/Professional Services |

$75 copay/visit (for room charges only - lab, x-ray & other services subject to deductible/coinsurance) |

$75 copay/visit (for room charges only - lab, x-ray & other services subject to deductible/coinsurance) |

| Lab & Diagnostic Services | 30% | 30% |

| Maternity Services | ||

| Hospital Services | 30% | 40% |

|

Physician Services (delivery & inpatient) |

30% (waived if enrolled in WellBaby Program within first trimester) |

40% |

| Prenatal Office Visit | $30 copay/visit | 40% |

| Preventive Services | ||

|

Preventive screenings/immunizations |

0% (no deductible) (limited to listed Preventive Services. Other preventive services subject to deductible and coinsurance) |

40% |

| Mental Health/Substance Use Disorder | ||

| Inpatient Services (Pre-Certification is recommended) |

30% | 40% |

| Outpatient Visit (this is a combined max of 4 visits at $0 copay for mental health & substance use disorder services) - Includes Telemedicine visits |

First 4 visits $0 copay, then $30 copay/visit (other services subject to deductible/coinsurance) |

40% |

| Rehabilitative Services Physical, Occupational, Speech, Cardiac, Respiratory, Pulmonary, and Massage Therapies; Acupuncture and Chiropractic | ||

|

Inpatient Services (Pre-Certification is recommended) |

30% Max: 30 days/Plan Year |

40% |

|

Outpatient Services Note: Acupuncture & Massage Therapy visits are processed In-Network, however, the member may be balance billed the difference between the billed charge and the allowed amount. |

$30 copay/visit |

40% |

| Extended Care Services | ||

| Home Health Care Visit (Prior Authorization is recommended) |

$30 copay/visit Max: 30 visits/Plan Year |

40% Max: 30 visits/Plan Year |

| Hospice Services | 30% Max: 6 months |

40% Max: 6 months |

|

Skilled Nursing Facility Services (Prior Authorization is recommended) |

30% Max: 30 days/Plan Year |

40% Max: 30 days/Plan Year |

| Miscellaneous Services | ||

| Allergy Shots |

$50 copay/visit |

40% |

| Durable Medical Equipment, Prosthetic Appliances & Orthotics (Prior Authorization is recommended for amounts greater than $2,500) |

30% Max: $200/Plan Year for foot orthotics |

40% Max: $200/Plan Year for foot orthotics |

| PKU Supplies (Includes treatment & medical foods) |

0% (no deductible) | 40% |

|

Hearing Aids (See SPD for benefit details) Note: Hearing Aids are processed In-Network |

30% 0% (no deductible) |

30% 0% (no deductible) |

| Dietary/Nutritional Counseling Visit - Includes Telemedicine visits |

First 16 visits $0 copay, |

40% |

| Obesity Management (Prior Authorization required) |

30% (must be enrolled in Take Control program for non-surgical treatment) |

40% |

|

TMJ (Prior Authorization recommended) |

30% (surgical treatment only) |

40% |

| Organ Transplants | ||

| Transplant Services (Prior Authorization recommended) |

30% | 40% |

| Out of Area Travel Reimbursement | ||

|

Travel reimbursement for patient only (See SPD for travel reimbursement details) |

0% (no deductible) - up to $1,500/Plan Year |

0% (no deductible) - up to $1,500/Plan Year |

| Wellness Program | ||

| Preventive Health Screenings Healthy Lifestyle Education & Support |

See Wellness Program information | |

| WellBaby Program | ||

| Take Control Lifestyle Management Program (Diabetes, Weight Loss, High Cholesterol, High Blood Pressure) | ||

|

Virgin Pulse Incentive Program |

||

Reminder:

Deductible applies to all covered services unless otherwise indicated or a copay applies.

Out-of-Network Providers may balance bill the difference between their billed charge and the allowed amount for

covered services.

Preventive Services

1. What Services are Preventive?

The MUS Medical Plan provides preventive care coverage that complies with the federal health care reform law, the Patient Protection and Affordable Care Act (PPACA). Services designated as preventive care include:

- covered periodic wellness visits

- covered certain screenings for symptom- free or disease-free individuals, and

- covered routine immunizations.

Note: When covered preventive care services are provided by In-Network Providers, the services are reimbursed at 100% of the allowed amount, without application of deductible, coinsurance, or copay. Preventive care services provided by an Out-of-Network Provider have a separate deductible, 40% coinsurance, and Out-of-Pocket maximum. An Out-of-Network Provider may balance bill the difference between their billed charge and the allowed amount.

The PPACA has used specific resources to identify the preventive services that require coverage: U.S. Preventive Services Task Force (USPSTF) A and B recommendations and the Advisory Committee on Immunization Practices (ACIP) recommendations adopted by the Centers for Disease Control (CDC). Guidelines for preventive care for infants, children, and adolescents, supported by the Health Resources and Services Administration (HRSA), come from two sources: Bright Futures Recommendations for Pediatric Health Care and the Uniform Panel of the Secretary’s Advisory Committee on Heritable Disorders in Newborns and Children.

2. Important Tips

- Accurate coding for preventive services by your health care provider is the key to accurate reimbursement by the Medical Plan. All standard correct medical coding practices should be observed.

- Also of importance is the difference between a “screening” test and a diagnostic, monitoring, or surveillance test. A “screening” test done on an asymptomatic person is a preventive service and is considered preventive even if the test results are positive for disease, but future tests would be diagnostic, for monitoring the disease or the risk factors for the disease. A test done because symptoms of disease are present is not a preventive screening and is considered diagnostic.

- Ancillary services directly associated with a “screening” colonoscopy are also considered preventive services. Therefore, the evaluation office visit with the doctor performing the colonoscopy, colonoscopy procedure, the ambulatory facility fee, anesthesiology (if necessary), and pathology will be reimbursed as preventive, provided they are submitted with accurate preventive coding.

Covered Preventive Services

|

Periodic Exams Appropriate screening tests per Bright Futures and other sources |

|

|

Well-Child Care |

Age 0 months through 4 years (up to 14 visits) Age 5 years through 17 years (1 visit/Plan Year) |

|

Adult Routine Exam Exams may include screening/counseling and/or risk factor reduction interventions for depression, obesity, tobacco use/abuse, drug and/or alcohol use/abuse |

Age 18 years through 65+ (1/Plan Year)

|

|

Preventive Screenings |

|

|

Anemia Screening |

Pregnant Women |

|

Bacteriuria Screening |

Pregnant Women |

|

Breast Cancer Screening (mammography) |

Women age 40+ (1/Plan Year) |

|

Cervical Cancer Screening (PAP) |

Women age 21 - 65 (1/Plan Year) |

|

Cholesterol Screening |

Men age 35+ (age 20 - 35 if risk factors for coronary heart disease are present) Women age 45+ (age 20 - 45 if risk factors for coronary heart disease are present) |

|

Colorectal Cancer Screening |

Fecal occult blood testing; 1/Plan Year or Sigmoidoscopy; every 5 years or Colonoscopy; every 10 years |

|

Prostate Cancer Screening (PSA) age 50+ |

1/Plan Year (age 40+ with risk factors) |

|

Osteoporosis Screening |

Post-menopausal women age 65+, or age 60+ with risk factors (1 bone density x-ray (DXA) / Plan Year) |

|

Abdominal Aneurysm Screening |

Men age 65 - 75 who have ever smoked (1 screening by ultrasound/Plan Year) |

|

Diabetes Screening |

Adults with high blood pressure |

|

HIV Screening |

Pregnant women and others at risk |

|

RH Incompatibility Screening |

Pregnant women |

|

Routine Immunizations |

|

|

Diphtheria, Tetanus, Pertussis (DTaP) (Tdap) (Td); Haemophilus Influenza (Hib); Hepatitis A (HepA) & B (HepB); Human Papillomavirus (HPV); Influenza; Measles, Mumps, Rubella (MMR); Meningococcal (MenACWY) (MenB), Pneumococcal (Pneumonia) (PCV13); Poliovirus (IPV); Rotavirus (RV); Chickenpox (Varicella); Zoster (Shingles); Coronavirus (COVID-19); Tuberculosis testing (TB). Influenza, Zoster (Shingles), and COVID-19 vaccinations are reimbursed at 100% via the Navitus Prescription Drug Plan. For recommended immunization schedules for all ages, visit the CDC website. |

|

Prescription Drug Plan

(included in Medical Plan)

Administered by Navitus Health Solutions

Who is eligible?

All MUS Medical Plan enrollees and their eligible dependents will automatically be enrolled in the Navitus Health Solutions Prescription Drug Plan (PDP) coverage (non-Medicare enrollees (Commercial Plan)/Medicare primary enrollees (MedicareRx Plan (Part D)). There is no separate premium and no deductible for prescription drugs.

How do I access my PDP information?

To access more information about the Navitus PDPs, including the MUS-specific participating network pharmacy directory and the complete prescription drug formulary (preferred drug list), you will need to register on the Navitus Member Portal. If you have questions regarding the drug formulary or pharmacy directory, contact Navitus Customer Care.

To determine your MUS PDP drug tier level and copay amount before going to the pharmacy, consult the Drug Schedule of Benefits, log into the Navitus Member Portal, or contact Navitus Customer Care.

How do I fill my prescriptions?

Prescription drugs may be obtained through the Plan at either a local retail pharmacy (up to a 34 or 90-day supply) or through a mail order pharmacy (90-day supply). Members who use maintenance medications can experience a significant cost-savings when filling their prescriptions for a 90-day supply.

Retail Pharmacy Network

NOTE: CVS/Target pharmacies are not part of the MUS PDP participating pharmacy network. If you choose to use these pharmacies, you will be responsible for all charges. This is not applicable to Navitus MedicareRx enrollees.

Mail Order Pharmacies

Ridgeway and Costco Pharmacies administer the mail order pharmacy program. If you are new to the mail order program, you can register online.

Specialty Pharmacy

Specialty Pharmacy

The preferred Specialty Pharmacy is Lumicera Health Services. Lumicera helps members who are taking prescription drugs that require special handling and/or administration to treat certain chronic illnesses or complex conditions by providing services that offer convenience and support. Ordering prescriptions with the specialty pharmacy is simple, contact Lumicera Customer Care.

You can access the Lumicera specialty pharmacy Frequently Asked Questions (FAQs).

Medicare Part D Plan

The Medicare PDP, Navitus MedicareRx, is a Medicare Part D prescription drug plan (PDP). Like all Medicare Part D plans, this Medicare PDP is approved by Medicare and run by a private company (Navitus).

- Enrollment in another Medicare Part D drug plan is not permitted.

- MUS Medicare primary Retiree Plan members cannot be covered on another MUS Medicare primary Retiree Plan as a legal spouse (dual enrollment).

- Medicare-eligible Plan members must be enrolled in BOTH Medicare Part A and B to be eligible for this drug plan and to remain covered on the MUS Medical Plan

Prescription Drug Plan

|

Drug Schedule of Benefits |

Retail (up to 34-day supply) |

Retail/Mail Order (90-day supply) |

|

Tier $0 (certain preventive medications (ACA, certain statins, Metformin, and Omeprazole)) |

$0 Copay |

$0 Copay |

|

Tier 1 (low cost, high-value generics and select brands that provide high clinical value) |

$15 Copay |

$30 Copay |

|

Tier 2 (preferred brands and select generics that are less cost effective) |

$50 Copay |

$100 Copay |

|

Tier 3 (non-preferred brands and generics that provide the least value because of high cost or low clinical value, or both) |

50% Coinsurance |

50% Coinsurance |

|

|

||

|

Tier 4 (Specialty) (specialty medications for certain chronic illnesses or complex diseases) $200 copay if filled at a preferred Specialty pharmacy 50% coinsurance, if filled at a non-preferred Specialty pharmacy (Does not apply to the Out-of-Pocket maximum) |

N/A |

N/A |

|

Out-of-Pocket Maximum |

Individual: $2,150/Plan Year (Commercial) Individual: $2,150/Calendar Year (MedicareRx) |

|

Questions:

Navitus Customer Care

call 24 Hours a Day | 7 Days a wk

Closed Thanksgiving and Christmas Day

Commercial Plan (Non-Medicare)

1-866-333-2757

Member Portal

MedicareRx Plan (Medicare)

1-866-270-3877

Member Portal

Lumicera Customer Care

1-855-847-3553

Monday - Thursday 7 a.m. to 6 p.m., Friday 7 a.m. - 5 p.m. MST

Dental Plan (optional)

Dental Plan (optional)

Administered by Delta Dental: 1-866-579-5717

Choices offers the Dental Select Plan option for Retirees and their eligible dependents.

Continuation of enrollment in the Dental Plan is a one-time opportunity for Retirees (and their eligible dependents) at retirement. Coverage is permanently forfeited if the Retiree fails to continue enrollment, cancels Dental coverage, or fails to pay premiums. Note: A legal spouse reaching age 65 is not a qualifying event for re-enrolling in Dental coverage.

| Select Plan – Enhanced Coverage | |

|---|---|

| Monthly Dental Plan Rates |

|

| Annual Benefit Maximum | $2,000 per covered individual |

|

Diagnostic & Preventive Services |

Twice/Plan Year:

|

|

Basic Restorative Services

|

|

|

Major Dental Services

|

|

|

Orthodontia Services |

|

Select Plan Benefit Highlights:

Diagnostic & Preventive Services

The Choices Select Plan allows MUS Plan members to obtain diagnostic & preventive services without those costs applying to the annual $2,000 maximum.

Orthodontic Benefits

The Choices Select Plan provides a $1,500 lifetime orthodontic benefit per covered individual. Benefits are paid at 50% of the allowed amount for covered services. Treatment plans usually include an initial down payment and ongoing monthly fees. If an initial down payment is required, the Plan will pay up to 50% of the initial payment, up to 1/3 of the total treatment charge. In addition, Delta Dental will establish a monthly reimbursement based on your provider’s monthly fee and your prescribed treatment plan.

Dental Fee Schedule

MUS dental claims are reimbursed based on a fixed dental fee schedule. The following subsets of the Choices Select Plan fee schedule includes the most common used procedure codes. The fee schedule’s fixed dollar amount is the maximum reimbursement amount paid by the Plan for the specified procedure code, regardless of provider network. Covered Dental Plan enrollees are responsible for the difference (if any) between the provider’s billed charge and the fee schedule’s maximum reimbursement amount.

Dental Plan enrollees have the freedom of choice to visit any licensed dentist, however,

Out-of-Pocket costs may

be reduced if seeing a Delta Dental Premier or PPO network dentist.

*The dental procedure codes and nomenclature are copyright of the American Dental Association. The procedures described and maximum reimbursement amounts indicated in the fee schedule are subject to the terms of the MUS-Delta Dental contract and Delta Dental processing policies. These allowances may be further reduced due to maximums, limitations, and exclusions. Please refer to the SPD for complete benefit and fee schedule information.

| Procedure Code | Description | Fee Schedule |

|---|---|---|

| D0120 | Periodic oral evaluation – established patient | $44.00 |

| D0140 | Limited oral evaluation – problem focused | $59.00 |

| D0145 | Oral evaluation for a patient under three years of age and counseling with primary caregiver | $48.00 |

| D0150 | Comprehensive oral evaluation – new or established patient | $66.00 |

| D0160 | Detailed and extensive oral evaluation – problem focused, by report | $139.00 |

| D0170 | Re-evaluation – limited, problem focused (established patient; not post-operative visit) | $52.00 |

| D0180 | Comprehensive periodontal evaluation – new or established patient | $72.00 |

| D0190 | Screening of a patient | $28.00 |

| D0191 | Assessment of a patient | $28.00 |

| D0210 | Intraoral – comprehensive series of radiographic images | $124.00 |

| D0220 | Intraoral – periapical first radiographic image | $26.00 |

| D0230 | Intraoral – periapical each additional radiographic image | $20.00 |

| D0240 | Intraoral – occlusal radiographic image | $25.00 |

| D0250 | Extra-oral – 2D projection radiographic image created using a stationary radiation source, and detector | $58.00 |

| D0270 | Bitewing – single radiographic image | $23.00 |

| D0272 | Bitewings – two radiographic images | $41.00 |

| D0273 | Bitewings – three radiographic images | $49.00 |

| D0274 | Bitewings – four radiographic images | $54.00 |

| D0277 | Vertical bitewings – 7 to 8 radiographic images | $75.00 |

| D0310 | Sialography | $411.00 |

| D0320 | Temporomandibular joint arthrogram, including injection | $622.00 |

| D0321 | Other temporomandibular joint radiographic images, by report | $224.00 |

| D0322 | Tomographic survey | $355.00 |

| D0330 | Panoramic radiographic image | $97.00 |

| D0340 | 2D cephalometric radiographic image – acquisition, measurement and analysis |

$88.00 |

| D0350 | 2D oral/facial photographic image obtained intra-orally or extra-orally | $33.00 |

| D0364 | Cone beam CT capture and interpretation with limited field of view - less than one whole jaw | $67.00 |

| D0365 | Cone beam CT capture and interpretation with field of view of one full dental arch - mandible | $158.00 |

| D0366 | Cone beam CT capture and interpretation with field of view of one full dental arch - mandible | $196.00 |

| D0367 | Cone beam CT capture and interpretation with field of view of one full dental arch - maxilla, with or without cranium | $162.00 |

| D0391 | Interpretation of diagnostic image by a practitioner not associated with capture of the image, including report | $89.00 |

| D0601 | Caries risk assessment and documentation, with a finding of low risk | $11.00 |

| D0602 | Caries risk assessment and documentation, with a finding of moderate risk | $11.00 |

| D0603 | Caries risk assessment and documentation, with a finding of high risk | $11.00 |

| D1110 | Prophylaxis – adult | $87.00 |

| D1120 | Prophylaxis – child (through age 13) | $58.00 |

| D1206 | Topical application of fluoride varnish (Child through age 18) | $31.00 |

| D1208 | Topical application of fluoride – excluding varnish (Child through age 18) | $28.00 |

| D1351 | Sealant – per tooth (Child through age 15) | $45.00 |

| D1352 | Preventive resin restoration in a moderate to high caries risk patient – permanent tooth (Child through age 15) | $54.00 |

| D1510 | Space maintainer – fixed, unilateral – per quadrant (Child through age 13) | $284.00 |

| D1516 | Space maintainer – fixed – bilateral, maxillary (Child through age 13) | $399.00 |

| D1517 | Space maintainer – fixed – bilateral, mandibular (Child through age 13) | $395.00 |

| D1551 | Re-cement or re-bond bilateral space maintainer – maxillary | $63.00 |

| D1552 | Re-cement or re-bond bilateral space maintainer - mandibular | $63.00 |

| D1556 | Removal of fixed unilateral space maintainer - per quadrant | $63.00 |

| D2140 | Amalgam – one surface, primary or permanent | $93.00 |

| D2150 | Amalgam – two surfaces, primary or permanent | $118.00 |

| D2160 | Amalgam – three surfaces, primary or permanent | $147.00 |

| D2161 | Amalgam – four or more surfaces, primary or permanent | $176.00 |

| D2330 | Resin-based composite – one surface, anterior | $112.00 |

| D2331 | Resin-based composite – two surfaces, anterior | $143.00 |

| D2332 | Resin-based composite – three surfaces, anterior | $174.00 |

| D2335 | Resin-based composite – four or more surfaces (anterior) | $214.00 |

| D2391 | Resin-based composite – one surface, posterior | $127.00 |

| D2392 | Resin-based composite – two surfaces, posterior | $162.00 |

| D2393 | Resin-based composite – three surfaces, posterior | $207.00 |

| D2394 | Resin-based composite – four or more surfaces, posterior | $241.00 |

| D2543 | Onlay - metallic - three surfaces | $375.00 |

| D2544 | Onlay - metallic - four or more surfaces | $545.00 |

| D2620 | Inlay – porcelain/ceramic – two surfaces | $335.00 |

| D2644 | Onlay – porcelain/ceramic – four or more surfaces | $553.00 |

| D2664 | Onlay – resin-based composite – four or more surfaces | $440.00 |

| D2710 | Crown - resin-based composite (indirect) | $284.00 |

| D2740 | Crown – porcelain/ceramic substrate | $497.00 |

| D2750 | Crown – porcelain fused to high noble metal | $463.00 |

| D2751 | Crown – porcelain fused to predominantly base metal | $420.00 |

| D2780 | Crown – ¾ cast high noble metal | $516.00 |

| D2783 | Crown – ¾ porcelain/ceramic | $488.00 |

| D2790 | Crown – full cast high noble metal | $520.00 |

| D2792 | Crown – full cast noble metal | $545.00 |

| D2920 | Re-cement or re-bond crown | $63.00 |

| D2921 | Reattachment of tooth fragment, incisal edge or cusp | $143.00 |

| D2928 | Prefabricated porcelain/ceramic crown - permanent tooth | $222.00 |

| D2929 | Prefabricated porcelain/ceramic crown – primary tooth | $252.00 |

| D2930 | Prefabricated stainless steel crown – primary tooth | $186.00 |

| D2931 | Prefabricated stainless steel crown – permanent tooth | $222.00 |

| D2940 | Protective restoration | $70.00 |

| D2950 | Core buildup, including any pins when required | $151.00 |

| D3110 | Pulp cap – direct (excluding final restoration) | $49.00 |

| D3220 | Therapeutic pulpotomy (excluding final restoration) – removal of pulp coronal to the dentinocemental junction and application of medicament | $121.00 |

| D3330 | Endodontic therapy, molar tooth (excluding final restoration) | $873.00 |

| D3346 | Retreatment of previous root canal therapy – anterior | $763.00 |

| D3347 | Retreatment of previous root canal therapy – premolar | $850.00 |

| D3410 | Apicoectomy – anterior | $776.00 |

| D4210 | Gingivectomy or gingivoplasty – four or more contiguous teeth or tooth bounded spaces per quadrant | $371.00 |

| D4270 | Pedicle soft tissue graft procedure | $620.00 |

| D4273 | Autogenous connective tissue graft procedure (including donor and recipient surgical sites) first tooth, implant, or edentulous tooth position in graft |

$703.00 |

| D4275 | Non-autogenous connective tissue graft (including recipient site and donor material) first tooth, implant, or edentulous tooth position in graft |

$916.00 |

| D4341 | Periodontal scaling and root planing – four or more teeth per quadrant | $173.00 |

| D4342 | Periodontal scaling and root planing – one to three teeth per quadrant | $117.00 |

| D4346 | Scaling in presence of generalized moderate or severe gingival inflammation – full mouth, after oral evaluation | $96.00 |

| D4355 | Full mouth debridement to enable a comprehensive periodontal evaluation and diagnosis on a subsequent visit | $104.00 |

| D4910 | Periodontal maintenance | $99.00 |

| D5110 | Complete denture – maxillary | $675.00 |

| D5120 | Complete denture – mandibular | $662.00 |

| D5130 | Immediate denture – maxillary | $783.00 |

| D5140 | Immediate denture – mandibular | $793.00 |

| D5211 | Maxillary partial denture – resin base (including retentive/clasping materials, rests, and teeth) | $464.00 |

| D5212 | Mandibular partial denture – resin base (including retentive/clasping materials, rests, and teeth) | $556.00 |

| D5226 | Mandibular partial denture - flexible base (including retentive/clasping materials, rests, and teeth) |

$643.00 |

| D5410 | Adjust complete denture – maxillary | $32.00 |

| D5421 | Adjust partial denture – maxillary | $46.00 |

| D5422 | Adjust partial denture – mandibular | $33.00 |

| D5511 | Repair broken complete denture base, mandibular | $86.00 |

| D5512 | Repair broken complete denture base, maxillary | $86.00 |

| D5640 | Replace broken teeth – per tooth | $102.00 |

| D5650 | Add tooth to existing partial denture | $117.00 |

| D5711 | Rebase complete mandibular denture | $320.00 |

| D5820 | Interim partial denture (including retentive/clasping materials, rests, and... | $216.00 |

| D5850 | Tissue conditioning, maxillary | $51.00 |

| D5851 | Tissue conditioning, mandibular | $51.00 |

| D6010 | Surgical placement of implant body: endosteal implant | $860.00 |

| D6240 | Pontic – porcelain fused to high noble metal | $499.00 |

| D6241 | Pontic – porcelain fused to predominantly base metal | $425.00 |

| D6242 | Pontic – porcelain fused to noble metal | $463.00 |

| D6245 | Pontic – porcelain/ceramic | $489.00 |

| D6740 | Retainer crown – porcelain/ceramic | $497.00 |

| D6750 | Retainer crown – porcelain fused to high noble metal | $507.00 |

| D6751 | Retainer crown – porcelain fused to predominantly base metal | $420.00 |

| D6752 | Retainer crown – porcelain fused to noble metal | $490.00 |

| D6790 | Retainer crown – full cast high noble metal | $498.00 |

| D7111 | Extraction, coronal remnants – primary tooth | $68.00 |

| D7140 | Extraction, erupted tooth or exposed root (elevation and/or forceps removal) | $119.00 |

| D7210 | Extraction, erupted tooth requiring removal of bone and/or sectioning of tooth, and including elevation of mucoperiosteal flap if indicated | $204.00 |

| D7220 | Removal of impacted tooth – soft tissue | $239.00 |

| D7230 | Removal of impacted tooth – partially bony | $283.00 |

| D7240 | Removal of impacted tooth – completely bony | $327.00 |

| D9110 | Palliative treatment of dental pain – per visit | $73.00 |

| D9120 | Fixed partial denture sectioning | $86.00 |

| D9222 | Deep sedation/general anesthesia – first 15 minutes | $280.00 |

| D9223 | Deep sedation/general anesthesia – each subsequent 15 minute increment | $135.00 |

| D9239 | Intravenous moderate (conscious) sedation/analgesia – first 15 minutes | $252.00 |

| D9243 | Intravenous moderate (conscious) sedation/analgesia – each subsequent 15 minute increment | $111.00 |

| D9310 | Consultation – diagnostic service provided by dentist or physician other than requesting dentist or physician | $67.00 |

| D9942 | Repair and/or reline of occlusal guard | $40.00 |

| D9944 | Occlusal guard – hard appliance, full arch | $283.00 |

| D9945 | Occlusal guard – soft appliance, full arch | $151.00 |

| D9946 | Occlusal guard – hard appliance, partial arch | $320.00 |

| D9947 | Custom sleep apnea appliance fabrication and placement | $273.00 |

| D9949 | Repair of a custom sleep apnea appliance | $40.00 |

| D9950 | Occlusion analysis – mounted case | $187.00 |

| D9951 | Occlusal adjustment – limited | $51.00 |

| D9952 | Occlusal adjustment – complete | $406.00 |

| D9953 | Reline custom sleep apnea appliance (indirect) | $40.00 |

Vision Hardware Plan (optional)

Administered by BlueCross BlueShield of Montana - 1-800-820-1674 or 1-406-447-8747

Choices offers a Vision Hardware Plan for Retirees and their eligible dependents.

Continuation of enrollment in the Vision Hardware Plan is a one-time opportunity for Retirees (and their eligible dependents) at retirement. Coverage is permanently forfeited if the Retiree fails to continue enrollment, cancels Vision Hardware coverage, or fails to pay premiums. Note: A legal spouse reaching age 65 is not a qualifying event for re-enrolling in Vision Hardware coverage.

Using Your Vision Hardware Plan Benefit

Quality vision care is important to your eye wellness and overall health care. Visit your vision provider, purchase hardware, and submit your claim form to BlueCross BlueShield of Montana (BCBSMT) for processing. The optional Vision Hardware Plan coverage is for hardware only. Eye Exams, whether preventive or medical, are covered under the Medical Plan (see Eye Exam -preventive & medical) in the Schedule of Medical Plan Benefits). Please refer to the SPD for complete Vision Hardware Plan benefits, limitations, and exclusions.

Monthly Vision Hardware Plan Rates

Retiree/Survivor Only $10.70

Retiree & Spouse $20.20

Retiree/Survivor & Child(ren) $21.26

Retiree & Family $31.18

| Service/Material | Coverage |

|---|---|

|

Eyeglass Frame and Lenses: Frame: One eyeglass frame per Plan Year, in lieu of contact lenses Lenses: One pair of prescription lenses per Plan Year, in lieu of contact lenses |

Up to $300 allowance toward the purchase of one eyeglass frame and one pair of prescription lenses, including single vision, bifocal, trifocal, progressive lenses; ultraviolet treatment; tinting; scratch-resistant coating; polycarbonate; anti-reflective coating. |

|

Contact Lenses: One pair or one single purchase of a supply of prescription contact lenses per Plan Year, in lieu of an eyeglass frame and prescription lenses |

Up to $200 allowance toward contact lens fitting and the purchase of conventional, disposable, or medically necessary* prescription contact lenses. |

*Prescription contact lenses that are required to treat medical or abnormal visual conditions, including but not limited to eye surgery (i.e., cataract removal), visual perception in the better eye that cannot be corrected to 20/70 through the use of eyeglasses, and certain corneal or other eye diseases (i.e., anisometropia, high ametropia, and keratoconus).

Filing a claim:

The Plan member may be responsible for vision hardware charges at the time of purchase. If the Provider does not bill for vision hardware purchases, the Provider should provide the Plan member with a walk-out statement that can be submitted to BCBSMT for reimbursement, along with a BCBSMT Claim Form.

MUS Wellness Program (optional)

The MUS Plan offers Wellness programs to covered Choices Medical Plan enrollees over the age of 18.

Wellness Health Screenings

WellChecks: Each campus location offers two free wellness health screenings (WellChecks) per Plan Year (July 1 - June 30). A free basic blood panel and biometric screening are provided at WellCheck, with additional optional tests available at discounted prices. MUS Wellness staff are present at most WellChecks to answer wellness related questions. Visit WellCheck for more information.

Online Registration: Online registration is required for all participants for WellCheck appointments. Register on It Starts With Me.

Lab Tests: Log into your It Starts With Me account for a complete listing of lab tests available at WellCheck.

Flu Shots: Flu shots are offered FREE in the fall, subject to national vaccine availability. Visit WellCheck for more information.

Wellness Incentive Program

Brought to you by

Retirees and their legal spouses who are covered on the Choices Medical Plan are eligible to participate in the Virgin Pulse Wellness Incentive Program!

Build healthy habits, have fun with family and friends, and experience the lifelong rewards of better wellbeing. Earn Pulse Cash by participating in wellness challenges and redeem for items in the Virgin Pulse Store.

Get started at Join VirginPulse.

Already registered? Visit the VirginPulse Member page.

For more information about the MUS Wellness incentive program, contact the MUS Wellness office at 406-994-6111

Healthy Lifestyle Education & Support

WellBaby Program:

WellBaby is a pregnancy program designed to help you achieve a healthier pregnancy. Enroll during your first trimester to take advantage of all program benefits, including copay/coinsurance waivers. For more information call 406-660-0082 or visit Wellbaby.

Take Control Lifestyle Management Program:

Take Control is a health coaching program that believes living well is within everyone’s reach. Take Control offers comprehensive and confidential education and support for the medical conditions listed below. Their unique and convenient telephonic delivery method allows Plan members to participate from anywhere and receive individual attention specific to each Plan member's needs. Plan members with any of the following conditions may enroll:

- Diabetes: Type I, Type II, Pre-diabetes, or Gestational (Fasting GLUC > 125)

- Weight Loss: High Body Mass Index (BMI > 24.99)

- High Blood Pressure: (Hypertension) (Systolic > 140 or Diastolic > 90)

- High Cholesterol: (Hyperlipidemia) (CHOL > 240 or TRIG > 200 or LDL > 150 or HDL < 40M/50F)

- WellBaby participants can join Take Control as part of the WellBaby program

Services provided include monthly health coaching and healthy lifestyle resources.

Benefits Pre-Authorized by your Health Coach may include:

- Visit with your In-Network primary health care provider ($0 copay).

- Sleep study (deductible/coinsurance waived).

- Additional counseling visits ($0 copay).

- Copay waivers for diabetic supplies.

For details, visit the MUS Take Control Program or contact Take Control MT at 1-800-746-2970.

Available to Non-Medicare enrollees only.

Stay Connected

For education and updates visit our Blog

Visit the MUS Wellness Website

Contact the MUS Wellness office at 406-994-6111

Additional Benefit Plan Information

Self-Audit Award Program

Be sure to check all medical health care provider bills and Explanation of Benefits (EOBs) from the Medical Plan claims administrator to ensure charges have not been duplicated or you have been billed for services you did not receive. When you detect billing errors that result in a claims adjustment, the Plan will share the savings with you! You may receive an award of 50% of the savings, up to a maximum of $1,000.

The Self-Audit Award Program is available to all MUS Medical Plan members who identify medical billing errors which:

- Have not already been detected by the Medical Plan claims administrator or reported by the health care provider.

- Include medical services which are allowable and covered by the MUS Medical Plan, and

- Total $50 or more in errant charges.

To receive the Self-Audit Award, the member must:

- Notify the Medical Plan claims administrator of the error before it is detected by the claims administrator or the health care provider.

- Contact the health care provider to verify the error and work out the correct billing, and

- Submit copies of the correct billing to the Medical Plan claims administrator for verification, claims adjustment and calculation of the Self-Audit Award.

Summary Plan Description (SPD)

All MUS Plan participants have the right to obtain a current copy of the SPD. Despite the use of “summary” in the title, this document contains the full legal description of the Plan’s medical, dental, vision hardware, and prescription drug benefits and should always be consulted when a specific question arises about the Plan.

Plan participants may request a hard copy of the SPD by contacting their campus HR/ Benefits office or the MUS Benefits office at 1-877-501-1722. The SPD is also available online.

Eligibility and enrollment rules for coverage in the MUS Plan for participants and their eligible dependents (who are NOT active employees within MUS), are published in the MUS SPD in these sections:

- Eligibility

- Enrollment, Changes in Enrollment, and Effective Dates of Coverage

- Leave, Layoff, Coverage Termination, Re-Enrollment, Surviving Dependent, and Retirement Options

- Continuation of Coverage Rights under the Consolidated Omnibus Budget Reconciliation Act (COBRA)

Each covered employee and retiree are responsible for understanding the rights and responsibilities for themselves and their eligible dependents for maintaining enrollment in the MUS Plan.

Retirees eligible for Medicare and paying Medicare Retiree monthly premium rates, as published in the Choices Retiree Workbook, are required to be continuously enrolled in BOTH Medicare Part A and Medicare Part B.

Coordination of Benefits (COB): Persons covered by a health care plan through the MUS AND by another non-liability health care coverage plan, whether private, employer-based, governmental (including Medicare and Medicaid), are subject to coordination of benefits rules as specified in the SPD, COB section. Rules vary from case to case by the circumstances surrounding the claim and by the active or retiree status of the member. No more than 100% of a claim’s allowed amount will be paid by the sum of all payments from all applicable coordinated insurance coverages.

Summary of Benefits and Coverage (SBC)

The SBC, required by PPACA, will outline what the MUS Medical Plan covers and what the cost share is for the member and the Plan for covered services.

Health Insurance Portability and Accountability Act of 1996 (“HIPAA”) Notice

The MUS Plan has a duty to safeguard and protect the privacy of all Plan members’ personally identifiable health information that is created, maintained, sent, or received by the Plan.

The MUS Plan contracts with individuals or entities, known as Business Associates, who perform various functions on the Plan’s behalf such as claims processing and other health-related services associated with the Plan, including claims administration or to provide support services, such as medical review or pharmacy benefit management services, etc.

The MUS Plan, in administering Plan benefits, shares and receives personally identifiable medical information concerning Plan members as required by law and for routine transactions concerning eligibility, treatment, payments, wellness programs (including WellChecks and lifestyle management programs), healthcare operations, and claims processing (including review of claims payments or denials, appeals, health care fraud and abuse detection, and compliance). Information concerning these categories may be shared, without a Plan participant’s written consent, between authorized MUS Benefits office employees and MUS Business Associates, the participant’s providers, or legally authorized governmental entities.

Glossary

Allowed Amount

A set dollar allowance for procedures/services that are covered by the Plan.

Balance Billing

This amount is the difference between the provider’s billed charge and the allowed amount for covered services provided by an Out-of-Network Provider or the billed amount for a non-covered service.

Benefit Plan Year

The period starting July 1 and ending June 30.

Certification/Pre-Certification

A determination by the Medical Plan claims administrator that a specific service - such as an inpatient hospital stay - is medically necessary. Pre-Certification is done in advance of a non-emergency admission by contacting the Medical Plan claims administrator.

Coinsurance

A percentage of the allowed amount for covered services that a member is responsible for paying, after paying any applicable deductible. For example, if Jack has met his deductible for In-Network medical costs ($1,250), he pays 30% of the allowed amount up to the Out-of-Pocket Maximum and the Plan pays 70%.

Copayment

A fixed dollar amount the member pays for a covered service, usually at the time the member receives the service. The Plan pays the remaining allowed amount.

Covered Service

Services that are determined to be medically necessary and are eligible for payment under the Plan.

Deductible

A set dollar amount that a member must pay for covered services before the Medical Plan pays. The deductible applies to the benefit Plan Year (July 1 through June 30). For example, Jack’s deductible is $1,250. Jack pays 100% of the allowed amount for covered services until his deductible has been met.

Diagnostic

A type of service that includes tests or exams usually performed for monitoring a disease or condition which you have signs, symptoms, or a prevailing medical history.

Emergency Services

Evaluation and treatment of a covered emergency medical condition (illness, injury, or serious condition). Emergency Services are covered everywhere; however, Out-of-Network Providers may balance bill the difference between the billed charge and the allowed amount for covered services.

Fee Schedule

A fee schedule is a complete listing of fees used by the Plan to reimburse providers and suppliers for providing selected covered services. The comprehensive listing of fee maximums is used to reimburse a provider on a fee-for-service or (fixed) flat-fee basis.

In-Network Provider

A provider who has a participating contract with the Plan claims administrator to provide services for Plan members and to accept the allowed amount as payment in full for covered services. Also called “Preferred Provider” or “Participating Provider”. Members will pay less Out-of-Pocket expenses for covered services if they see an In-Network Provider.

Out-of-Network Provider

A provider who provides services to a member but does not have a participating contract with the Plan claims administrator. Also called “Non-Preferred Provider” or "Non-Participating Provider”. Members will pay more Out-of-Pocket expenses for covered services if they see an Out-of-Network Provider. Out-of-Network Providers may balance bill the difference between the billed charge and the allowed amount for covered services.

Out-of-Pocket Maximum

The maximum amount of money a member pays toward the cost of covered services. Out-of-Pocket expenses include deductibles, copayments, and coinsurance. For example, Jack reaches his $4,350 Out-of-Pocket Maximum. Jack has seen his doctor often and paid $4,350 total (deductible + coinsurance + copays). The Plan pays 100% of the allowed amount for covered services for the remainder of the benefit Plan Year (July 1 - June 30). Balance billing amounts for covered services (the difference between Out-of-Network Provider billed charges and the allowed amount) do not apply to the Out-of-Pocket Maximum.

Plan

Healthcare benefits coverage offered to eligible members through the employer to assist with the cost of covered services.

Preventive Services

Routine health care, including screenings and exams, to prevent or discover illnesses, disease, or other health problems.

Prior Authorization

A process that determines whether a proposed service, medication, supply, or ongoing treatment is considered medically necessary as a covered service.

Primary Care Physician

A physician (M.D. – Medical Doctor or D.O. – Doctor of Osteopathic Medicine, nurse practitioner, clinical nurse specialist or physician assistant) who directly provides or coordinates a range of health care services for or helps access health care services for a patient.

Screening

A type of preventive service that includes tests or exams to detect the presence of something, usually performed when you have no symptoms, signs, or a prevailing medical history of a disease or condition.

Specialist

A physician specialist who focuses on a specific area of medicine to diagnose, manage, prevent, or treat certain types of symptoms and conditions.

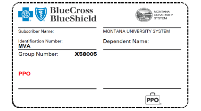

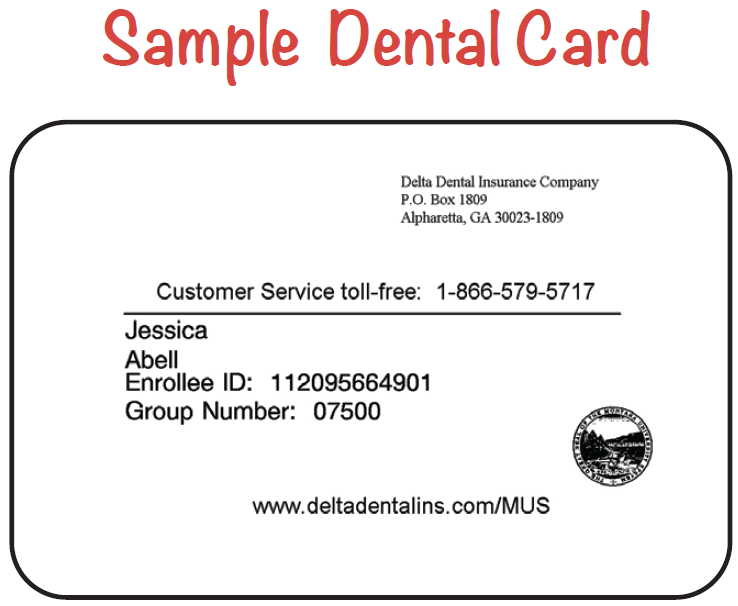

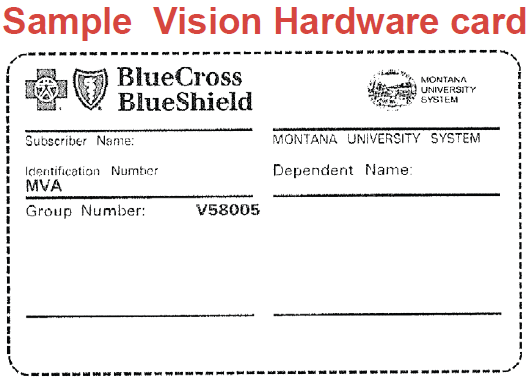

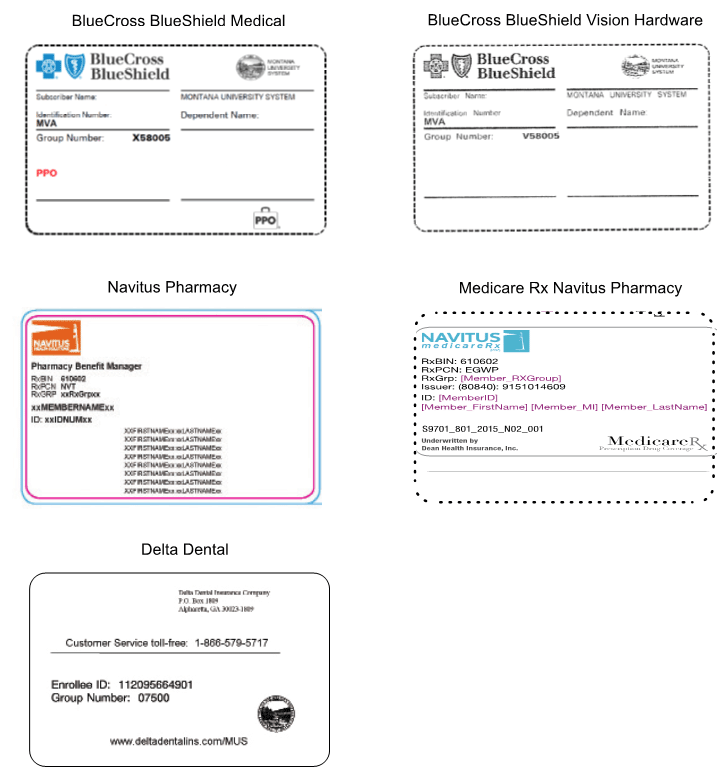

Insurance Card Examples

Resources

Montana University System Benefits Office

Office of the Commissioner of Higher Education

1-877-501-1722 * Fax (406) 449-9170

MEDICAL PLAN & VISION HARDWARE PLAN

BLUECROSS BLUESHIELD OF MONTANA

1-800-820-1674 or 1-406-447-8747

DENTAL PLAN

PRESCRIPTION DRUG PLANS

NAVITUS COMMERCIAL PLAN (Non-Medicare)

1-866-333-2757

NAVITUS MEDICARE Rx PLAN (Medicare)

1-866-270-3877

LUMICERA HEALTH SERVICES

1-855-847-3553

COSTCO MAIL ORDER PHARMACY

1-800-607-6861

Fax: 1-888-545-4615

RIDGEWAY MAIL ORDER PHARMACY

1-800-630-3214

Fax: 406-642-6050