2021-2022 Choices Actives Workbook

Active Benefits 2021-2022

Montana University System

Table of Contents

Campus Human Resources/Benefit Office Contacts

How Choices Works

Mandatory Benefits (must choose)

- Medical Plan

- Medical Plan Rates

- Schedule of Medical Plan Benefits

- Preventive Services

- Prescription Drug Plan

- Dental Plan

- Basic Life/Accidental Death & Dismemberment (AD&D) & Long Term Disability Insurance

Optional Benefits (voluntary)

- Vision Hardware Plan

- MUS Wellness Program

- Employee Assistance Program (EAP)

- Flexible Spending Accounts (FSA)

- Supplemental Life Insurance

- Supplemental Accidental Death & Dismemberment (AD&D)

Additional Benefit Plan Information

- Dependent Hardship Waiver & Self Audit Award Program

- Self-Audit Award Program

- Summary Plan Description (SPD)

- Summary of Benefits & Coverage (SBC)

- HIPAA

- Glossary

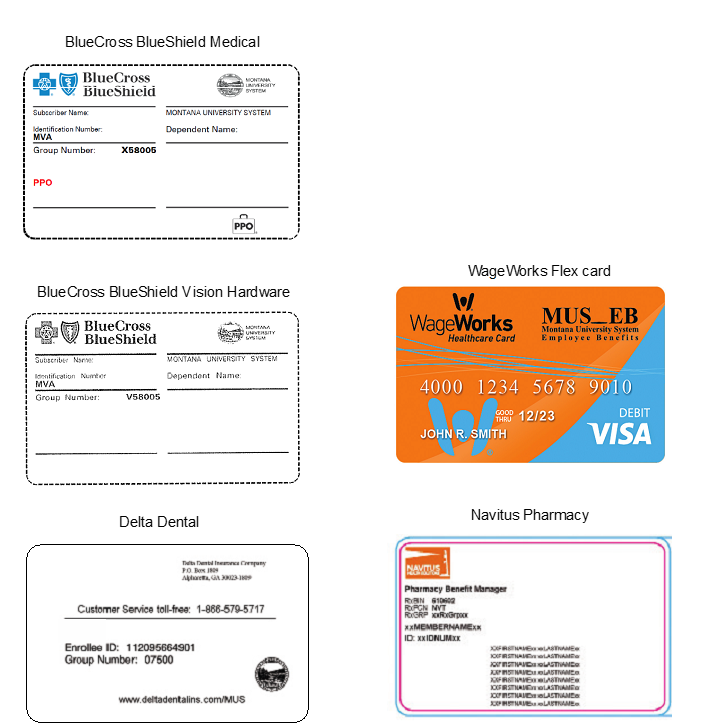

- Insurance Card Examples

- Resources

Questions?

If you have questions about your benefits or enrolling in the Benefitsolver online enrollment system, please contact your campus Human Resources/Benefits office directly.

Campus Human Resources/Benefits Office Contacts

MSU - Bozeman

920 Technology Blvd, Ste. A, Bozeman, MT 59717

406-994-3651

MSU - Billings

1500 University Dr., Billings, MT 59101

406-657-2278

MSU - Northern

300 West 11th Street, Havre, MT 59501

406-265-3568

Great Falls College - MSU

2100 16th Ave. S., Great Falls, MT 59405

406-268-3701

UM - Missoula

32 Campus Drive, LO 252, Missoula, MT 59812

406-243-6766

Helena College - UM

1115 N. Roberts, Helena MT 59601

406-447-6925

UM - Western

710 S. Atlantic St., Dillon, MT 59725

406-683-7010

MT Tech - UM

1300 W. Park St., Butte, MT 59701

406-496-4380

OCHE, MUS Benefits Office

560 N. Park Ave, Helena, MT 59620

877-501-1722

Dawson Community College

300 College Dr., Glendive, MT 59330

406-377-9430

Flathead Valley Community College

777 Grandview Dr., Kalispell, MT 59901

406-756-3981

2715 Dickinson St., Miles City, MT 59301

406-874-6292

Choices Enrollment for an Employee

This workbook is your guide to Choices – The Montana University System’s employee benefits program that lets you match your benefits to your individual and family situation. To get the most out of this opportunity to design your own benefits package, you need to consider your benefit needs, compare them to the options available under Choices, and enroll for the benefits you have chosen. Please read the information in this workbook carefully. If you have any questions, contact your campus Human Resources/Benefits Office. This enrollment workbook is not a guarantee of benefits. Consult your enrollment workbook or Summary Plan Description.

Who’s Eligible:

1. Permanent faculty or professional staff members regularly scheduled to work at least 20 hours per week or 40 hours over two weeks for a continuous period of more than six months in a 12-month period.

2. Temporary faculty or professional staff members scheduled to work at least 20 hours per week or 40 hours over two weeks for a continuous period of more than six months in a 12-month period, or who do so regardless of schedule.

3. Seasonal faculty or professional staff members regularly scheduled to work at least 20 hours per week or 40 hours over two weeks for a continuous period of more than six months in a 12-month period, or who do so regardless of schedule.

4. Academic or professional employees with an individual contract under the authority of the Board of Regents which provides for eligibility under one of the above requirements.

Note: Student employees who occupy positions designated as student positions by a

campus

are not eligible to join the MUS Group Benefits Plan.

Waiver of Coverage:

You have the option to waive benefits coverage with the Montana University System Group Benefits Plan. To waive coverage, you must actively elect to waive coverage in the online enrollment system by your enrollment deadline, verifying you are waiving coverage. If you do not actively elect to waive coverage, coverages will continue (existing employees) or you will be defaulted into coverage (new employees) as outlined below. The cost of default coverage will be within the employer contribution amount.

Please note, there is no continuing or default coverage for Flexible Spending Accounts (FSAs), as these accounts must be actively elected each benefit plan year.

If you waive coverage, all of the following will apply:

- You waive coverage for yourself and for all eligible dependents.

- You waive all mandatory and optional Choices coverages, including Medical, Dental, Vision Hardware, Life/Accidental Death and Dismemberment (AD&D), Long Term Disability (LTD), and Flexible Spending Accounts.

- You forfeit the monthly employer contribution toward benefits coverage.

- You and your eligible children cannot re-enroll unless and until you have a qualifying event or until the next annual enrollment period.

- Your legal spouse cannot be added to the Plan unless and until they have a qualifying event.

If you default coverage, your coverage will be defaulted to Employee only coverage and will consist of:

- Employee Only – Medical Plan

- Employee Only – Basic Dental Plan

- Basic Life/AD&D – Option 1 ($15,000)

- Long Term Disability – Option 1 (60% of pay/180-day waiting period)

Enrolling family members:

Enrollment for FY2022 is Closed Enrollment for legal spouses unless there is a qualifying event. Eligible children under the age of 26 may be added during the annual enrollment period or if there is a qualifying event.

If you are a new employee, you may enroll your eligible dependents for benefits under Choices, including Medical, Dental, Vision Hardware, optional supplemental life and AD&D insurance coverage.

Eligible family members include your:

Legal spouse: Legally married or certified common-law married spouses, as defined under Montana law, will be eligible for enrollment as a dependent on the MUS Plan. Only legally married or common-law spouses with a certified affidavit of common-law marriage will be eligible for enrollment on the Plan during the employee’s initial enrollment period or within 63 days of a qualifying event.

Eligible dependent children under age 26*: Children include your natural children, step-children, and children placed in your home for adoption before age 18 or for whom you have court-ordered custody or legal guardianship.

*Coverage may continue past age 26 for an eligible unmarried dependent child who is mentally or physically disabled and incapable of self-support and is currently covered on the MUS Plan. Eligibility is subject to review each benefit plan year.

How to Enroll:

- New benefits eligible employees have the option of enrolling themselves and any eligible dependents, or waiving all coverages, during a 30-day initial enrollment period, that begins the day following the date of hire or the date of benefits eligibility under the Plan.

- Employees may make benefit changes from among the benefit plan options during annual enrollment each benefit plan year or within 63 days of a qualifying event based on Plan rules.

- Each benefit option in Choices has a monthly cost associated with it. These costs

are shown in the online benefits enrollment system and in the Medical Plan section below.

Mandatory (must choose):

- Medical Plan

- Prescription Drug Plan (included in Medical)

- Dental Plan

- Basic Life and AD&D Insurance

- Long Term Disability

Optional (voluntary):

- Employees make their benefit elections online in the Benefitsolver online enrollment system. Instructions on how to login and navigate the online Benefitsolver enrollment system are below. The online benefits enrollment system will walk you through your coverage options and monthly costs.

- Select the Benefits Enrollment button to enroll.

Company Key: musbenefitsIf the benefits you choose cost . . .

- The same or less than the employer contribution, you will not see any change in your paycheck.

- More than the employer contribution, you will pay the difference through automatic payroll deductions.

Your annual Choices elections remain in effect for the entire plan benefit year (July 1 – June 30) following enrollment or unless you have a change in status (qualifying event).

Qualifying Events

- Marriage

- Birth of a child

- Adoption of a child

- Loss of eligibility for other health insurance coverage - voluntarily canceling other health insurance does not constitute loss of eligibility

Documentation to support the change will be required.

Qualifying events may allow limited benefit changes.

If you have questions about the enrollment process or enrolling in the Benefitsolver online benefits enrollment system, please contact your campus Human Resources/Benefits Office directly. Questions about qualifying events should be directed to your campus Human Resources/Benefits Office or consult the Summary Plan Description (SPD).

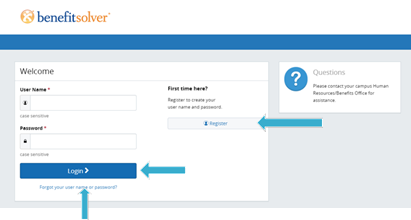

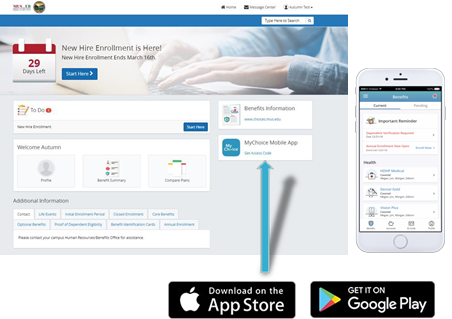

BenefitSolver System

LOG IN

Visit the MUS Choices website Home page from any computer or mobile device, click on the Benefits Enrollment button on the Choices Home page and Login with your User Name and Password.

New users must Register and answer security questions. The case-sensitive Company Key is musbenefits.

Need to reset your User Name or Password?

- Click Forgot your User Name or Password?

- Enter your Social Security Number, birth date and the Company Key: musbenefits.

- Answer your security phrase.

- Enter and confirm your new password, then click

- Continue and Login with your new credentials.

GET STARTED

Click Start Here and follow the instructions to make your benefit elections by the deadline on the calendar. If you miss the deadline, you will not be able to make any changes to your benefit elections until the next annual enrollment period.

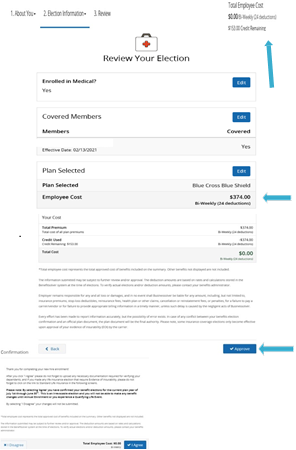

MAKE YOUR ELECTIONS

Using Next, Looks Good, and Back to navigate, review your options as you move through the enrollment process.

Select plan(s) and what dependent(s) you would like to cover.

Track your benefit elections and costs on each page.

REVIEW AND CONFIRM

Make sure your personal information, benefit elections, dependent(s), and beneficiary(ies) are accurate and Approve your enrollment.

To finalize your enrollment, click I Agree.

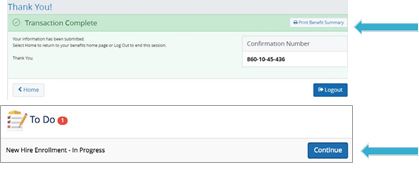

FINALIZE

When your enrollment is complete, you will receive a confirmation number and you can also Print Benefit Summary.

Your To Do list will notify you if you have any additional actions needed to complete your enrollment.

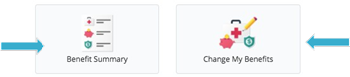

REVIEW YOUR BENEFITS

You have 24/7 access to your benefit summary that shows your benefit elections. Click Benefit Summary on the Home page to review your current benefits at any time.

FIND BENEFIT INFORMATION

View your MUS Choices benefit plan information.

If you have questions about your enrollment, contact your campus Human Resources/Benefits Office directly.

CHANGE YOUR BENEFITS

Once approved, your benefit elections will remain in effect until the end of the benefit plan year, unless you have a qualifying life event, such as marriage, divorce or birth of a child.

- Click on Change My Benefits.

- Select Life Event and the event type.

- Review your options and follow the election steps previously outlined to complete your changes.

**IMPORTANT: You must make changes within 63 days of the qualifying event and provide the required documentation for verification.

CHANGE YOUR BENEFICIARY(IES)

Beneficiary changes can be made at any time of the year.

- Click on Change My Benefits

- Select Basic Info and Change of Beneficiary.

- Follow the prompts to complete your change.

Download the MyChoiceSM Mobile App

- Visit your device’s app store and download the MyChoice by Businessolver® Mobile App.

- Visit your Benefitsolver Home page to Get Access Code.

- Activate the app with your access code. (If you don’t use the code within 20 minutes, you’ll need to generate a new one.)

- Follow the instructions within the Mobile App to have easy access to your benefits on the go.

How the Choices Medical Plan Works

Plan members receive medical services from a health care provider. If the provider is In-Network, the provider will submit a claim for the member. The Medical Plan claim’s administrator processes the claim and sends an Explanation of Benefits (EOB) to the member and the provider, showing the member’s payment responsibilities (deductible, copayments, and/or coinsurance costs). The Plan then pays the remaining allowed amount. The provider will not bill the member the difference between the billed charge and the allowed amount.

If the provider is Out-of-Network, the member must verify if the provider will submit the claim or if the member must submit the claim. The Medical Plan claim’s administrator processes the claim and sends an EOB to the member showing the member’s payment responsibilities (deductible, coinsurance, and any difference between the billed charge and the allowed amount (balance billing)).

Definition of Terms

In-Network Providers – Providers who have contracted with the Plan claim’s administrator to manage and deliver care at agreed upon prices. Members may self-refer to In-Network providers and specialists. There is a cost savings for services received In-Network. You pay a $25 copayment for Primary Care Physician (PCP) visits and a $40 copayment for Specialty provider visits to In-Network providers (no deductible) and 25% coinsurance (after deductible) for most In-Network hospital/ facility services.

Out-of-Network Providers – Providers who do not have a contract with the Plan claim’s administrator. You pay 35% of the allowed amount (after a separate deductible) for services received Out-of-Network.

Out-of-Network providers can also balance bill you for any difference between their billed charge and the allowed amount.

Emergency Services – Emergency services are covered everywhere. However, Out-of-Network providers may balance bill the difference between the allowed amount and the billed charge.

Deductible – The amount you pay each benefit plan year before the Plan begins to pay.

Copayment - A fixed dollar amount you pay for a covered service that a member is responsible for paying. The Medical Plan pays the remaining allowed amount.

Coinsurance – A percentage of the allowed amount for covered charges you pay, after paying any applicable deductible.

Out-of-Pocket Maximum - The maximum amount of money you pay toward the cost of covered health care services. Out-of-Pocket expenses include deductibles, copayments, and coinsurance.

Important: Verify the network status of your providers. This is an integral cost savings component of each of your plan choices.

Medical Plan (mandatory)

Administered by

BlueCross BlueShield of Montana

1-800-820-1674 or 447-8747

Choices offers a Medical Plan for Employees and their eligible dependents.

| Coverage for | Medical Plan Monthly Rates |

|---|---|

| Employee/Survivor Only | $748 |

| Employee & Spouse | $1,075 |

| Employee & Child(ren) / Survivor & Child(ren) | $994 |

| Employee & Family | $1,327 |

The employer contribution for FY2022 is $1,054 per month for eligible active employees (applies to pre-tax benefits only).

Medical Plan Costs FY2022

| Costs | Medical Plan In-Network |

Medical Plan |

|---|---|---|

| Annual Deductible Applies to all covered services, unless otherwise noted or copayment is indicated. |

$750/Individual $1,500/Family |

Separate $750/Individual Separate $1,750/Family |

| Copayment (outpatient office visits) Primary Care Physician Visit (PCP) Specialty Provider Visit |

$25 copay $40 copay |

N/A N/A |

| Coinsurance Percentages (% of allowed charges member pays) |

25% | 35% |

|

Annual Out-of-Pocket Maximum (Maximum amount paid by member in a benefit plan year for covered services; includes deductibles, copays, and coinsurance) |

$4,000/Individual $8,000/Family |

Separate $6,000/Individual |

*Services from an Out-of-Network provider have separate deductibles, % coinsurance, and Out-of-Pocket maximums.

An Out-of-Network provider can balance bill the difference between the allowed amount and the billed charge.

Examples of Medical costs to Plan and Member - Primary Care Physician Visit

Benefit Plan Year July 1 – June 30

(In-Network)

Jack’s Plan deductible is $750, his coinsurance is 25%, and his Out-of-Pocket max is $4,000.

Jack hasn’t reached his deductible yet and he visits the doctor and has lab work. He pays $25 for the office visit and 100% of the allowed amount for covered lab charges. For example, Jack’s doctor visit totals $1,000. The office visit is $150 and lab work is $850. The Plan allows $100 for the office visit and $400 for the lab work. Jack pays $25 for the office visit and $400 for the lab work. The Plan pays $75 for the office visit and $0 for the lab work. The In-Network provider writes off $500.

Jack has seen the doctor several times and reaches his $750 In-Network deductible. His plan pays some of the costs of his next visit. He pays $25 for the office visit and 25% of the allowed amount for lab work and the Plan pays the remainder of the office visit + 75% of the allowed amount. For example, Jack’s doctor visit totals $1,000. The office visit is $150 and lab work is $850. The Plan allows $100 for the office visit and $400 for the lab work. Jack pays $25 for the office visit and $100 for the lab work. The Plan pays $75 for the office visit and $300 for the lab work. The In-Network provider writes off $500.

Jack reaches his $4,000 Out-of-Pocket maximum. Jack has seen his doctor often and

paid $4,000 total (deductible +

coinsurance + copays). The Plan pays 100% of the allowed amount for covered charges

for the remainder of the benefit plan year. For example, Jack’s doctor visit totals

$1,000. The office visit is $150 and lab work is $850. The Plan allows $100 for

the office visit and $400 for the lab work. Jack pays $0 and the Plan pays $500.

The In-Network provider writes off $500.

(Out-of-Network)

Jack’s Plan deductible is $750, his coinsurance is 35%, and his Out-of-Pocket max is $6,000.

Jack hasn’t reached his deductible yet and he visits the doctor. He pays 100% of

the provider charge. Only allowed amounts apply to his

deductible. For example, the provider charges $1,000. The Plan allowed amount is

$500. $500 applies to Jack’s Out-of-Network deductible. Jack must pay the provider

the full $1,000.

Jack has seen the doctor several times and reaches his $750 Out-of-Network deductible. His plan pays some of the costs of his next visit. He pays 35% of the allowed amount and any difference between the provider charge and the Plan allowed amount. The Plan pays 65% of the allowed amount. For example, the provider charges $1,000. The Plan allowed amount is $500. Jack pays 35% of the allowed amount ($175) + the difference between the provider charge and the Plan allowed amount ($500). Jack’s total responsibility is $675. The Plan pays 65% of the allowed amount ($325).

Jack reaches his $6,000 Out-of-Pocket maximum. Jack has seen his doctor often and paid $6,000 total (deductible + coinsurance). The Plan pays 100% of the allowed amount for covered charges for the remainder of the benefit plan year. Jack pays the difference between the provider charge and the allowed amount. For example, the provider charges $1,000. The Plan allowed amount is $500. Jack pays $500 and the Plan pays $500.

Schedule of Medical Plan Benefits

| Services | In-Network Copay/Coinsurance | Out-of-Network Coinsurance |

|---|---|---|

| Hospital Inpatient Services Pre-Certification of non-emergency inpatient hospitalization is strongly recommended | ||

| Room & Board Charges | 25% | 35% |

| Ancillary Services | 25% | 35% |

|

Surgical Services (See Summary Plan Description for surgeries requiring prior authorization) |

25% | 35% |

| Hospital Outpatient Services | ||

| Outpatient Services | 25% | 35% |

| Outpatient Surgi-Center Services | 25% | 35% |

| Physician/Professional Provider Services (not listed elsewhere) | ||

| Primary Care Physician (PCP) Office Visit - Includes Telemedicine and Naturopathic visits |

$25 copay/visit for office visit only - lab, x-ray & other procedures are subject to deductible/coinsurance |

35% Note: There is no network for Naturopaths, |

|

Specialty Provider Office Visit - Includes Telemedicine visits |

$40 copay/visit for office visit only - lab, x-ray & other procedures are subject to deductible/coinsurance |

35% |

| Inpatient/Outpatient Physician Services | 25% | 35% |

| Lab/Ancillary/Misc. Services | 25% | 35% |

| Eye Exam (preventive or medical) |

0% one/yr |

35% one/yr |

| Second Surgical Opinion |

0%/visit for office visit only - lab, x-ray & other procedures are subject to deductible/coinsurance |

35% |

| Emergency Services | ||

| Ambulance Services for Medical Emergency | $200 copay/transport | $200 copay/transport |

| Emergency Room Charges |

$250 copay/visit for room charges only - lab, x-ray |

$250 copay/visit for room charges only - lab, x-ray |

| Professional Provider Services | 25% | 25% |

| Urgent Care Services | ||

| Facility/Professional Services |

$75 copay/visit for room charges only - lab, x-ray |

$75 copay/visit for room charges only - lab, x-ray |

| Lab & Diagnostic Services | 25% | 25% |

| Maternity Services | ||

| Hospital Services | 25% | 35% |

| Physician Services (delivery & inpatient) | 25% (waived if enrolled in WellBaby Program within first trimester) |

35% |

| Prenatal Office Visit | 25% copay/visit (waived if enrolled in WellBaby Program within first trimester) |

35% |

| Preventive Services | ||

|

Preventive screenings/immunizations |

0% (limited to Preventive Services. Other preventive services subject to deductible and coinsurance) |

35% |

| Mental Health/Chemical Dependency Services | ||

| Inpatient Services (Pre-Certification is recommended) |

25% | 35% |

| Outpatient Visit (this is a combined max of 4 visits at $0 copay for mental health and chemical dependency services) - Includes Telemedicine visits |

First 4 visits $0 copay, then 25% copay/visit |

35% |

|

Psychiatrist Visit - Includes Telemedicine visits |

$40 copay/visit | 35% |

| Rehabilitative Services Physical, Occupational, Speech, Cardiac, Respiratory, Pulmonary, and Massage Therapy; Acupuncture; and Chiropractic | ||

|

Inpatient Services (Pre-Certification is recommended) |

25% Max: 30 days/yr |

35% Max: 30 days/yr |

| Outpatient Services (this is a combined max of 60 visits for all outpatient rehabilitative services) - Includes Telemedicine visits |

$25 copay/visit |

35% Note: There is no network for |

| Extended Care Services | ||

| Home Health Care Visit (Prior Authorization is recommended) |

$25 copay/visit Max: 30 visits/yr |

35% Max: 30 visits/yr |

| Hospice Services | 25% Max: 6 months |

35% Max: 6 months |

|

Skilled Nursing Facility Services (Prior Authorization is recommended) |

25% Max: 30 days/yr |

35% Max: 30 days/yr |

| Miscellaneous Services | ||

| Allergy Shots |

$40 copay/visit deductible & coinsurance waived |

35% |

| Durable Medical Equipment, Prosthetic Appliances & Orthotics (Prior Authorization is required for amounts greater than $2,500) |

25% Max: $200 for foot orthotics |

35% Max: $200 for foot orthotics |

| PKU Supplies (Includes treatment & medical foods) |

0% (no deductible) | 35% |

| Dietary/Nutritional Counseling Visit - Includes Telemedicine visits |

First 8 visits $0 copay, then $25 copay/visit |

35% |

| Obesity Management (Prior Authorization required) |

25% Must be enrolled in Take Control for non-surgical treatment |

35% |

|

TMJ Services (Prior Authorization required) |

25% Surgical treatment only |

35% |

| Organ Transplants | ||

| Transplant Services (Prior Authorization required) |

25% | 35% |

| Travel Reimbursement | ||

| Travel reimbursement for patient only - If services are not available in local area (Prior Authorization required) |

0% up to $1,500/yr. |

0% up to $1,500/yr. |

| Wellness Program | ||

| Preventive Health Screenings Healthy Lifestyle Education & Support |

See Wellness Program information | |

| WellBaby Program | ||

| Take Control Lifestyle Mgmt. Program Diabetes, Weight Loss, High Cholesterol, Tobacco Use, High Blood Pressure | ||

Reminder:

Deductible applies to all covered services unless otherwise indicated or a copay applies.

Out-of-Network providers can balance bill the difference between their billed charge

and the allowed amount.

Preventive Services

What Services are Preventive

The MUS Medical Plan provides preventive care coverage that complies with the federal health care reform law, the Patient Protection and Affordable Care Act (PPACA). Services designated as preventive care include:

- periodic wellness visits,

- certain designated screenings for symptom free or disease-free individuals, and

- designated routine immunizations.

When preventive care is provided by In-Network providers, services are reimbursed at 100% of the allowed amount, without application of deductible, coinsurance, or copay. Services from an Out-of-Network provider have a 35% coinsurance and a separate deductible and Out-of-Pocket maximum. An Out-of-Network provider can balance bill the difference between the allowed amount and the billed charge.

The PPACA has used specific resources to identify the preventive services that require coverage: U.S. Preventive Services Task Force (USPSTF) A and B recommendations and the Advisory Committee on Immunization Practices (ACIP) recommendations adopted by the Center for Disease Control (CDC). Guidelines for preventive care for infants, children, and adolescents, supported by the Health Resources and Services Administration (HRSA), come from two sources: Bright Futures Recommendations for Pediatric Health Care and the Uniform Panel of the Secretary’s Advisory Committee on Heritable Disorders in Newborns and Children.

U.S. Preventive Services Task Force

Advisory Committee on Immunization Practices (ACIP)

Important Tips

- Accurate coding for preventive services by your health care provider is the key to accurate reimbursement by your health care plan. All standard correct medical coding practices should be observed.

- Also of importance is the difference between a “screening” test and a diagnostic, monitoring, or surveillance test. A “screening” test done on an asymptomatic person is a preventive service and is considered preventive even if the test results are positive for disease, but future tests would be considered diagnostic, for monitoring the disease or the risk factors for the disease. A test done because symptoms of disease are present is not a preventive screening and is considered diagnostic.

- Ancillary services directly associated with a “screening” colonoscopy are also considered preventive services. Therefore, the evaluation office visit with the doctor performing the colonoscopy, the colonoscopy procedure, the ambulatory facility fee, anesthesiology (if necessary), and pathology will be reimbursed as preventive, provided they are submitted with accurate preventive coding.

Covered Preventive Services

Note: When preventive care is provided by In-Network providers, services are reimbursed at 100% of the allowed amount, without application of deductible, coinsurance, or copay. Services from an Out-of-Network provider have a 35% coinsurance and a separate deductible and Out-of-Pocket maximum. An Out-of-Network provider can balance bill the difference between the allowed amount and the billed charge.

|

Periodic Exams Appropriate screening tests per Bright Futures and other sources |

|

|

Well-Child Care |

Age 0 months through 4 yrs (up to 14 visits) Age 5 yrs through 17 yrs (1 visit per benefit plan year) |

|

Adult Routine Exam Exams may include screening/counseling and/or risk factor reduction interventions for depression, obesity, tobacco use/abuse, drug and/or alcohol use/abuse |

Age 18 yrs through 65+ (1 visit per benefit plan year) |

|

Preventive Screenings |

|

|

Anemia Screening |

Pregnant Women |

|

Bacteriuria Screening |

Pregnant Women |

|

Breast Cancer Screening (mammography) |

Women age 40+ (1 per benefit plan year) |

|

Cervical Cancer Screening (PAP) |

Women age 21 - 65 (1 per benefit plan year) |

|

Cholesterol Screening |

Men age 35+ (age 20 - 35 if risk factors for coronary heart disease are present) Women age 45+ (age 20 - 45 if risk factors for coronary heart disease are present) |

|

Colorectal Cancer Screening |

Fecal occult blood testing; 1 per benefit plan year OR Sigmoidoscopy; every 5 yrs OR Colonoscopy; every 10 yrs |

|

Prostate Cancer Screening (PSA) age 50+ |

1 per benefit plan year (age 40+ with risk factors) |

|

Osteoporosis Screening |

Post-menopausal women age 65+, or age 60+ with risk factors (1 bone density x-ray (DXA)) |

|

Abdominal Aneurysm Screening |

Men age 65 - 75 who have ever smoked (1 screening by ultrasound per benefit plan year) |

|

Diabetes Screening |

Adults with high blood pressure |

|

HIV Screening |

Pregnant women and others at risk |

|

RH Incompatibility Screening |

Pregnant women |

|

Routine Immunizations |

|

|

Diphtheria, tetanus, pertussis (DTaP) (Tdap)(TD), Haemophilus influenza (HIB), Hepatitis A & B, Human Papillomavirus (HPV), Influenza, Measles, Mumps, Rubella (MMR), Meningococcal, Pneumococcal (pneumonia), Poliovirus, Rotavirus, Varicella (smallpox), Zoster (shingles). Influenza and Zoster (Shingles) vaccinations are reimbursed at 100% via the Navitus Pharmacy benefit. For recommended immunization schedules for all ages, visit the CDC website. |

|

Prescription Drug Plan (included in Medical Plan)

Your prescription drug coverage is managed by Navitus Health Solutions.

Who is eligible?

The Prescription Drug Plan (PDP) is a benefit for all benefits eligible Montana University System Benefit Plan enrollees and their eligible dependents. Any member enrolled in the Medical Plan will automatically receive Navitus Health Solutions prescription drug coverage. There is no separate premium and no deductible for prescription drugs.

To determine your drug tier level and copay amount before going to the pharmacy, consult the Drug Schedule of Benefits, log into the Navitus Member Portal or call Navitus Customer Care.

The Navitus Drug Formulary List and Pharmacy Directory can be found on the Navitus website. You will need to register on the Navitus Navi-Gate for Members web portal to access the MUS-specific drug formulary (preferred drug list), drug tier level, and pharmacy directory. If you have questions regarding the drug formulary list or pharmacy directory, please contact Navitus Customer Care.

How do I fill my prescriptions?

Prescription drugs may be obtained through the Plan at either a local retail pharmacy (up to a 34 or 90-day supply) or through a mail order pharmacy (90-day supply). Members who use maintenance medications can experience a significant cost-savings when filling their prescriptions for a 90-day supply.

Retail Pharmacy Network

NOTE: CVS/Target pharmacies are not part of the Montana University System Pharmacy Plan network. If you choose to use these pharmacies, you will be responsible for all charges.

Mail Order Pharmacies

Ridgeway, Costco, and miRx Pharmacies administer the mail order pharmacy program. If you are new to the mail order program, you can register online.

Specialty Pharmacy

The preferred Specialty Pharmacy is Lumicera Health Services. Lumicera helps members who are taking prescription drugs that require special handling and/or administration to treat certain chronic illnesses or complex conditions by providing services that offer convenience and support. Ordering new prescriptions with this specialty pharmacy is simple, just call a Patient Care Specialist to get started at 1-855-847-3553.

You can also find a list of Lumicera specialty pharmacy Frequently Asked Questions (FAQs).

|

Drug Schedule of Benefits |

Retail (up to 34-day supply) |

Retail/Mail Order (90-day supply) |

|

Tier $0 (certain preventive medications (ACA, certain statins, metformin, and omeprazole) |

$0 Copay |

$0 Copay |

|

Tier 1 (low cost, high-value generics and select brands that provide high clinical value) |

$15 Copay |

$30 Copay |

|

Tier 2 (preferred brands and select generics that are less cost effective) |

$50 Copay |

$100 Copay |

|

Tier 3 (non-preferred brands and generics that provide the least value because of high cost or low clinical value, or both) |

50% Coinsurance (Does not apply to the |

50% Coinsurance |

|

|

||

|

Tier 4 (Specialty) (specialty medications for certain chronic illnesses or complex diseases) $200 copay if filled at a preferred Specialty pharmacy 50% coinsurance, if filled at a non-preferred Specialty pharmacy (Does not apply to the Out-of-Pocket maximum) |

N/A |

N/A |

|

Out-of-Pocket Maximum |

Individual: $2,150 per benefit plan year Family: $4,300 per benefit plan year |

|

Questions:

Navitus Customer Care

call 24 Hours a Day | 7 Days a wk

1-866-333-2757

Secure Member Portal

Costco

1-800-607-6861

Monday - Friday 5 a.m. to 7 p.m. PST

Specialty Pharmacy

Lumicera Health Services

Customer Care: 1-855-847-3553

Monday - Friday 8 a.m. to 6 p.m.

Dental Plan (mandatory)

Delta Dental

1-866-579-5717

Choices offers Employees and their eligible dependents two Dental Plan options to

choose from: Basic Plan or Select Plan.

|

|

Basic Plan - Preventive Coverage |

Select Plan - Enhanced Coverage |

|

|

Employee/Survivor Only $18 Employee & Spouse $34 Employee/Survivor & Child(ren) $34 Employee & Family $49 |

Employee/Survivor Only $43 Employee & Spouse $82 Employee/Survivor & Child(ren) $82 Employee & Family $116 |

|

Annual Benefit Maximum |

$750 per covered individual |

$2,000 per covered individual |

|

Diagnostic & Preventive |

Twice per benefit plan year:

Initial and periodic oral exam Cleaning Complete series of intraoral X-rays |

Twice per benefit plan year:

Initial and periodic oral exam Cleaning Complete series of intraoral X-rays

Note: The above services do not count towards the $2,000 annual benefit maximum (see below). |

|

Basic Restorative Services |

Not covered |

Amalgam filling Endodontic treatment Periodontic treatment Oral surgery Removal of impacted teeth |

|

Major Dental Services |

Not covered |

Crown Root canal Complete lower and upper denture Dental implant Occlusal guards |

|

Orthodontia Services |

Not covered |

Available to all Select Plan covered members. $1,500 lifetime benefit/individual |

Select Plan Benefit Highlights:

Diagnostic & Preventive Services

The Choices Select Plan allows MUS Plan members to obtain diagnostic & preventive services without those costs applying to the annual $2,000 maximum.

Orthodontic Benefits

The Choices Select Plan allows a $1,500 lifetime orthodontic benefit per covered individual. Benefits are paid at 50% of the allowed amount for authorized services. Treatment plans usually include an initial down payment and ongoing monthly fees. If an initial down payment is required, Choices will pay up to 50% of the initial payment, up to 1/3 of the total treatment charge. In addition, Delta Dental (the Dental Plan claims administrator) will establish a monthly reimbursement based on your provider’s monthly fee and your prescribed treatment plan.

Dental Fee Schedule

Dental claims are reimbursed based on a dental fee schedule. The following subsets of the Select Plan and Basic Plan fee schedules include the most common used procedure codes. Please note the Basic Plan provides coverage for a limited range of services, including diagnostic and preventive treatment.

The fee schedule’s dollar amount is the maximum reimbursement for the specified procedure

code. Covered members are responsible for the difference (if any) between the provider’s

billed charge and the fee schedule‘s

reimbursement amount. Blue shaded codes are for the Basic Plan ONLY. All Codes (shaded and non-shaded) are for the Select Plan.

The CDT codes and nomenclature are copyright of the American Dental Association. The

procedures described and maximum allowances indicated on this table are subject to

the terms of the MUS-Delta Dental contract and Delta Dental processing policies. These

allowances may be further reduced due to maximums, limitations, and exclusions.

Please refer to the Summary Plan Description (SPD) for complete listing.

| Procedure Code | Description | Fee Schedule |

|---|---|---|

| D0120 | Periodic oral evaluation – established patient | $44.00 |

| D0140 | Limited oral evaluation – problem focused | $59.00 |

| D0145 | Oral evaluation for a patient under three years of age and counseling with primary caregiver | $47.00 |

| D0150 | Comprehensive oral evaluation – new or established patient | $65.00 |

| D0160 | Detailed and extensive oral evaluation – problem focused, by report | $139.00 |

| D0170 | Re-evaluation – limited, problem focused (established patient; not post-operative visit) | $52.00 |

| D0180 | Comprehensive periodontal evaluation – new or established patient | $72.00 |

| D0190 | Screening of a patient | $28.00 |

| D0191 | Assessment of a patient | $28.00 |

| D0210 | Intraoral – complete series of radiographic images | $122.00 |

| D0220 | Intraoral – periapical first radiographic image | $26.00 |

| D0230 | Intraoral – periapical each additional radiographic image | $20.00 |

| D0240 | Intraoral – occlusal radiographic image | $25.00 |

| D0250 | Extra-oral – 2D projection radiographic image created using a stationary radiation source, and detector | $58.00 |

| D0270 | Bitewing – single radiographic image | $23.00 |

| D0272 | Bitewings – two radiographic images | $41.00 |

| D0273 | Bitewings – three radiographic images | $49.00 |

| D0274 | Bitewings – four radiographic images | $54.00 |

| D0277 | Vertical bitewings – 7 to 8 radiographic images | $75.00 |

| D0310 | Sialography | $411.00 |

| D0320 | Temporomandibular joint arthrogram, including injection | $622.00 |

| D0321 | Other temporomandibular joint radiographic images, by report | $224.00 |

| D0322 | Tomographic survey | $355.00 |

| D0330 | Panoramic radiographic image | $97.00 |

| D1110 | Prophylaxis – adult | $87.00 |

| D1120 | Prophylaxis – child (through age 13) | $58.00 |

| D1206 | Topical application of fluoride varnish (Child through age 18) | $31.00 |

| D1208 | Topical application of fluoride – excluding varnish (Child through age 18) | $28.00 |

| D1351 | Sealant – per tooth (Child through age 15) | $45.00 |

| D1352 | Preventive resin restoration in a moderate to high caries risk patient – permanent tooth (Child through age 15) | $54.00 |

| D1510 | Space maintainer – fixed, unilateral – per quadrant (Child through age 13) | $280.00 |

| D1516 | Space maintainer – fixed – bilateral, maxillary (Child through age 13) | $388.00 |

| D1517 | Space maintainer – fixed – bilateral, mandibular (Child through age 13) | $388.00 |

| D1520 | Space maintainer – removable, unilateral – per quadrant (Child through age 13) | $393.00 |

| D1526 | Space maintainer – removable – bilateral, maxillary (Child through age 13) | $538.00 |

| D1527 | Space maintainer – removable – bilateral, mandibular (Child through age 13) | $538.00 |

| D1551 | Re-cement or re-bond bilateral space maintainer – maxillary | $63.00 |

| D1552 | Re-cement or re-bond bilateral space maintainer – mandibular | $63.00 |

| D1553 | Re-cement or re-bond unilateral space maintainer – per quadrant | $63.00 |

| D1556 | Removal of fixed unilateral space maintainer – per quadrant | $63.00 |

| D1557 | Removal of fixed bilateral space maintainer – maxillary | $63.00 |

| D1558 | Removal of fixed bilateral space maintainer – mandibular | $63.00 |

| D1575 | Distal shoe space maintainer - fixed, unilateral – per quadrant | $239.00 |

| D2140 | Amalgam – one surface, primary or permanent | $93.00 |

| D2150 | Amalgam – two surfaces, primary or permanent | $118.00 |

| D2160 | Amalgam – three surfaces, primary or permanent | $147.00 |

| D2161 | Amalgam – four or more surfaces, primary or permanent | $176.00 |

| D2330 | Resin-based composite – one surface, anterior | $109.00 |

| D2331 | Resin-based composite – two surfaces, anterior | $141.00 |

| D2332 | Resin-based composite – three surfaces, anterior | $170.00 |

| D2335 | Resin-based composite – four or more surfaces or involving incisal angle (anterior) | $209.00 |

| D2391 | Resin-based composite – one surface, posterior | $124.00 |

| D2392 | Resin-based composite – two surfaces, posterior | $159.00 |

| D2393 | Resin-based composite – three surfaces, posterior | $203.00 |

| D2394 | Resin-based composite – four or more surfaces, posterior | $238.00 |

| D2510 | Inlay – metallic – one surface | $292.00 |

| D2520 | Inlay – metallic – two surfaces | $344.00 |

| D2542 | Onlay – metallic – two surfaces (12 years and older) | $419.00 |

| D2610 | Inlay – porcelain/ceramic – one surface | $292.00 |

| D2620 | Inlay – porcelain/ceramic – two surfaces | $335.00 |

| D2642 | Onlay – porcelain/ceramic – two surfaces (12 years and older) | $453.00 |

| D2650 | Inlay – resin-based composite – one surface | $292.00 |

| D2651 | Inlay – resin-based composite – two surfaces | $335.00 |

| D2662 | Onlay – resin-based composite – two surfaces (12 years and older) | $371.00 |

| D2740 | Crown – porcelain/ceramic substrate | $492.00 |

| D2750 | Crown – porcelain fused to high noble metal | $463.00 |

| D2751 | Crown – porcelain fused to predominantly base metal | $410.00 |

| D2780 | Crown – ¾ cast high noble metal | $516.00 |

| D2783 | Crown – ¾ porcelain/ceramic | $488.00 |

| D2790 | Crown – full cast high noble metal | $515.00 |

| D2930 | Prefabricated stainless steel crown – primary tooth | $186.00 |

| D2931 | Prefabricated stainless steel crown – permanent tooth | $222.00 |

| D2932 | Prefabricated resin crown | $221.00 |

| D2933 | Prefabricated stainless steel crown with resin window | $222.00 |

| D2940 | Protective restoration | $70.00 |

| D2950 | Core buildup, including any pins when required | $151.00 |

| D3110 | Pulp cap – direct (excluding final restoration) | $49.00 |

| D3220 | Therapeutic pulpotomy (excluding final restoration) – removal of pulp coronal to the dentinocemental junction and application of medicament | $121.00 |

| D3330 | Endodontic therapy, molar tooth (excluding final restoration) | $858.00 |

| D3346 | Retreatment of previous root canal therapy – anterior | $759.00 |

| D3347 | Retreatment of previous root canal therapy – premolar | $828.00 |

| D3410 | Apicoectomy – anterior | $762.00 |

| D3425 | Apicoectomy – molar (first root) | $765.00 |

| D3430 | Retrograde filling – per root | $153.00 |

| D4210 | Gingivectomy or gingivoplasty – four or more contiguous teeth or tooth bounded spaces per quadrant | $364.00 |

| D4249 | Clinical crown lengthening – hard tissue | $455.00 |

| D4260 | Osseous surgery (including elevation of a full thickness flap and closure) – four or more contiguous teeth or tooth bounded spaces per quadrant | $1,000.00 |

| D4270 | Pedicle soft tissue graft procedure | $620.00 |

| D4341 | Periodontal scaling and root planing – four or more teeth per quadrant | $170.00 |

| D4342 | Periodontal scaling and root planing – one to three teeth per quadrant | $112.00 |

| D4346 | Scaling in presence of generalized moderate or severe gingival inflammation – full mouth, after oral evaluation | $95.00 |

| D4355 | Full mouth debridement to enable a comprehensive oral evaluation and diagnosis on a subsequent visit | $104.00 |

| D4910 | Periodontal maintenance | $96.00 |

| D5110 | Complete denture – maxillary | $658.00 |

| D5120 | Complete denture – mandibular | $662.00 |

| D5130 | Immediate denture – maxillary | $764.00 |

| D5140 | Immediate denture – mandibular | $777.00 |

| D5211 | Maxillary partial denture – resin base (including retentive/clasping materials, rests, and teeth) | $442.00 |

| D5212 | Mandibular partial denture – resin base (including retentive/clasping materials, rests, and teeth) | $535.00 |

| D5213 | Maxillary partial denture – cast metal framework with resin denture bases (including retentive/clasping materials, rests and teeth) | $703.00 |

| D5214 | Mandibular partial denture – cast metal framework with resin denture bases (including retentive/clasping materials, rests and teeth) | $695.00 |

| D5225 | Maxillary partial denture – flexible base (including any clasps, rests and teeth) | $488.00 |

| D5226 | Mandibular partial denture – flexible base (including any clasps, rests and teeth) | $617.00 |

| D5411 | Adjust complete denture – mandibular | $32.00 |

| D5611 | Repair resin partial denture base, mandibular | $89.00 |

| D5612 | Repair resin partial denture base, maxillary | $89.00 |

| D5640 | Replace broken teeth – per tooth | $99.00 |

| D5650 | Add tooth to existing partial denture | $114.00 |

| D5660 | Add clasp to existing partial denture – per tooth | $160.00 |

| D5710 | Rebase complete maxillary denture | $320.00 |

| D5711 | Rebase complete mandibular denture | $320.00 |

| D5720 | Rebase maxillary partial denture | $314.00 |

| D5721 |

Rebase mandibular partial denture |

$360.00 |

| D5820 | Interim partial denture (maxillary) | $216.00 |

| D5821 | Interim partial denture (mandibular) | $233.00 |

| D5850 | Tissue conditioning, maxillary | $51.00 |

| D5851 | Tissue conditioning, mandibular | $51.00 |

| D5863 | Overdenture – complete maxillary | $930.00 |

| D6010 | Surgical placement of implant body: endosteal implant | $855.00 |

| D6210 | Pontic – cast high noble metal | $622.00 |

| D6212 | Pontic – cast noble metal | $365.00 |

| D6214 | Pontic – titanium and titanium alloys | $528.00 |

| D6240 | Pontic – porcelain fused to high noble metal | $491.00 |

| D6241 | Pontic – porcelain fused to predominantly base metal | $425.00 |

| D6242 | Pontic – porcelain fused to noble metal | $463.00 |

| D6740 | Retainer crown – porcelain/ceramic | $492.00 |

| D6750 | Retainer crown – porcelain fused to high noble metal | $499.00 |

| D6752 | Retainer crown – porcelain fused to noble metal | $490.00 |

| D6790 | Retainer crown – full cast high noble metal | $498.00 |

| D6791 | Retainer crown – full cast predominantly base metal | $402.00 |

| D6794 | Retainer crown – titanium and titanium alloys | $548.00 |

| D7111 | Extraction, coronal remnants – primary tooth | $68.00 |

| D7140 | Extraction, erupted tooth or exposed root (elevation and/or forceps removal) | $115.00 |

| D7210 | Extraction, erupted tooth requiring removal of bone and/or sectioning of tooth, and including elevation of mucoperiosteal flap if indicated | $199.00 |

| D7220 | Removal of impacted tooth – soft tissue | $237.00 |

| D7230 | Removal of impacted tooth – partially bony | $283.00 |

| D7240 | Removal of impacted tooth – completely bony | $326.00 |

| D7850 | Surgical discectomy, with/without implant | $1,500.00 |

| D7860 | Arthrotomy | $1,500.00 |

| D7971 | Excision of pericoronal gingiva | $120.00 |

| D9110 | Palliative (emergency) treatment of dental pain – minor procedure | $70.00 |

| D9120 | Fixed partial denture sectioning | $86.00 |

| D9222 | Deep sedation/general anesthesia – first 15 minutes | $280.00 |

| D9223 | Deep sedation/general anesthesia – each subsequent 15 minute increment | $134.00 |

| D9239 | Intravenous moderate (conscious) sedation/analgesia – first 15 minutes | $252.00 |

| D9243 | Intravenous moderate (conscious) sedation/analgesia – each subsequent 15 minute increment | $111.00 |

| D9310 | Consultation – diagnostic service provided by dentist or physician other than requesting dentist or physician | $67.00 |

| D9942 | Repair and/or reline of occlusal guard | $40.00 |

| D9944 | Occlusal guard – hard appliance, full arch | $273.00 |

| D9945 | Occlusal guard – soft appliance, full arch | $146.00 |

| D9946 | Occlusal guard – hard appliance, partial arch | $320.00 |

| D9950 | Occlusion analysis – mounted case | $187.00 |

| D9951 | Occlusal adjustment – limited | $51.00 |

| D9952 | Occlusal adjustment – complete | $406.00 |

Delta Dental Fee examples

How to select a Delta Dental network dentist that will best suit your needs and your pocket book!

Understand the difference between a PPO and Premier network dentist.

Finding a Delta Dental Network Dentist:

The MUS Dental Plan utilizes a fee schedule so you know in advance exactly how much the Plan will pay for each covered service. It is important to understand that a dentist’s billed charges may be greater than the Plan benefit fee schedule amount, resulting in balance billing. When a dentist contracts with Delta Dental, they agree to accept Delta Dental’s allowed fee as full payment. This allowed fee may be greater than the MUS Plan benefit fee schedule amount in which case, the dentist may balance bill you up to the difference between the allowed fee and the MUS Plan benefit fee schedule amount.

While you have the freedom of choice to visit any licensed dentist under the Plan, you may want to consider visiting a Delta Dental network dentist to reduce your Out-of-Pocket costs.

Montana University System plan members will usually save when they visit a Delta Dental network dentist. Delta Dental Preferred Provider Organization (PPO) network dentists agree to lower levels of allowed fees and therefore offer the most savings. Delta Dental Premier network dentists also agree to a set level of allowed fees, but not as low as with a PPO network dentist. Therefore, when visiting a Premier network dentist, MUS members usually see some savings, just not as much as with a PPO network dentist. The best way to understand the difference in fees is to view the examples below.

Use the Find a Dentist search to help you select a network dentist that is best for you!

The following claim example for an adult cleaning demonstrates how lower Out-of-Pocket patient costs can be achieved when you visit a Delta Dental network dentist (Select Plan coverage). The example compares the patient’s share of costs at each network level below:

|

|

PPO Network |

Premier Network |

Out-of-Network Dentist |

|

What the dentist bills |

$87 |

$87 |

$87 |

|

Dentists allowed fee with Delta Dental |

$57 |

$71 |

No fee agreement with Delta Dental |

|

MUS Plan fee schedule amount |

$83 |

$83 |

$83 |

|

What you pay |

$0 |

$0 |

$4 |

The following claim example for a crown demonstrates how lower Out-of-Pocket patient costs can be achieved when you visit a Delta Dental network dentist (Select Plan coverage). The example compares the patient’s share of costs at each network level below:

|

|

PPO Network |

Premier Network |

Out-of-Network Dentist |

|

What the dentist bills |

$1,000 |

$1,000 |

$1,000 |

|

Dentists allowed fee with Delta Dental |

$694 |

$822 |

No fee agreement with Delta Dental |

|

MUS Plan fee schedule amount |

$423 |

$423 |

$423 |

|

What you pay |

$271 |

$399 |

$577 |

Life/AD&D Insurance & Long Term Disability (mandatory)

Administered by

Standard Life Insurance

1-800-759-8702

Basic Life/AD&D Insurance:

This is an Employee only benefit.

Basic life insurance coverage under Choices pays benefits to your beneficiary or beneficiaries if you die from most causes while coverage is in effect. Accidental Death & Dismemberment (AD&D) insurance coverage under Choices adds low-cost accidental death protection by paying benefits in the event your death is due to accidental causes. Full or partial AD&D benefits are also payable to you following certain serious accidental injuries.

No evidence of insurability is required.

Basic Life/AD&D Options & Monthly Rates

Option 1 $15,000 $1.28 for both

Option 2 $30,000 $2.56 for both

Option 3 $48,000 $4.08 for both

Long Term Disability:

This is an Employee only benefit.

Long Term Disability (LTD) coverage can help protect your income in the event you become disabled and unable to work. Choices includes three LTD plan options designed to supplement other sources of disability income that may be available to you. The three LTD plan options differ in the amount of your pay they replace, when benefits become payable, and monthly premium costs.

Long Term Disability Options & Monthly Rates

Option 1 60% of pay/180 day waiting period $4.54

Option 2 66 2/3% of pay/180 day waiting period $9.06

Option 3 66 2/3% of pay/120 day waiting period $11.30

Benefit Options:

Option 1: 60% of pre-disability earnings, to a maximum benefit of $9,200 per month. The minimum monthly benefit is the greater of $100 or 10% of your LTD benefit before reduction by deductible income.

Option 2: 66-2/3% of pre-disability earnings, to a maximum benefit of $9,200 per month. The minimum monthly benefit is $100 or 10% of your LTD benefit before reduction by deductible income.

Option 3: 66-2/3% of pre-disability earnings, to a maximum benefit of $9,200 per month. The minimum monthly benefit is $100 or 10% of your LTD benefit before reduction by deductible income.

Employees increasing coverage one level during annual enrollment or due to a qualifying event will be subject to a pre-existing condition exclusion for disabilities occurring during the first 12 months that the increase in coverage is effective. Any coverage existing for at least 12 months prior to the increase will not be subject to the pre-existing condition exclusion.

Employees on a leave status may not be eligible for LTD coverage. Please consult with your campus Human Resources/Benefits Office.

Do you have other Disability Income?

The level of LTD coverage you select ensures that you will continue to receive a percentage of your base pay each month if you become totally disabled.

Some of the money you receive may come from other sources, such as Social Security, Workers’ Compensation, or other group disability benefits. Your Choices LTD benefit will be offset by any amounts you receive from these sources. The total combined income will equal the benefit level you selected.

The following applies to both Basic Life/AD&D Insurance and Long Term Disability

- If you are a new employee, you may elect any level of coverage during initial enrollment.

- An employee may increase one level of coverage during annual enrollment.

- An employee may decrease their coverage to any level during annual enrollment.

- An employee may increase or decrease their coverage one level due to a qualifying event, as long as the change is consistent with the event (such as, a dependent is disenrolled, coverage can be decreased one level).

Vision Hardware Plan (optional)

Administered by

BlueCross BlueShield of Montana

1-800-820-1674 or 1-406-447-8747

Choices offers a Vision Hardware Plan for Employees and their eligible dependents.

Using Your Vision Hardware Benefit

Quality vision care is important to your eye wellness and overall health care. Accessing your Vision Hardware Plan benefit is easy. Simply select your provider, purchase your hardware, and submit your claim form to BlueCross BlueShield of Montana for processing. The optional vision coverage is a hardware benefit only. Eye Exams, whether preventive or medical, are covered under the Medical Plan (see Eye Exam (preventive & medical) in the Schedule of Medical Plan Benefits). Please refer to the Summary Plan Description (SPD) for complete Vision Hardware Plan benefits and plan exclusions.

Monthly Vision Hardware Plan Rates

Employee/Survivor Only $10.70

Employee & Spouse $20.20

Employee/Survivor & Child(ren) $21.26

Employee & Family $31.18

|

Service/Material |

Coverage |

|---|---|

|

Eyeglass Frame and Lenses: Frame: One eyeglass frame per benefit plan year, in lieu of contact lenses Lenses: One pair of prescription lenses per benefit plan year, in lieu of contact lenses |

Up to $300 allowance toward the purchase of one eyeglass frame and one pair of prescription lenses, including single vision, bifocal, trifocal, progressive lenses; ultraviolet treatment; tinting; scratch-resistant coating; polycarbonate; anti-reflective coating. The Plan member may be responsible for charges at the time of purchase. |

|

Contact Lenses: One purchase per benefit plan year, in lieu of eyeglass frame and prescription lenses

|

Up to $200 allowance toward contact lens fitting and the purchase of conventional, disposable, or medically necessary* contact lenses. The Plan member may be responsible for charges at the time of purchase. |

*Contact lenses that are required to treat medical or abnormal visual conditions, including but not limited to eye surgery (i.e., cataract removal), when visual acuity cannot be corrected to 20/70 in the better eye with eyeglasses, and certain corneal or other eye diseases.

Filing a claim:

When a Plan member purchases vision hardware, a walk-out statement should be provided by the Provider. This walk-out statement should be submitted to BlueCross BlueShield of Montana for reimbursement, along with a Vision Hardware Claim Form.

MUS Wellness Program (optional)

The Montana University System (MUS) Benefit Plan offers Wellness services to covered adult Medical Plan members (employees, retirees, legal spouse, COBRA enrollees, and covered dependent children over the age of 18).

Preventive Health Screenings

WellCheck:

Each campus offers preventive health screenings for adult Medical Plan members called WellChecks. A free basic blood panel and biometric screening are provided at WellCheck, with optional additional tests available at discounted prices. Representatives from MUS Wellness are also present at most WellChecks to answer wellness related questions. Adult Medical Plan members over the age of 18 are eligible for two free WellChecks per benefit plan year (July 1 - June 30). Go to Wellness WellCheck for more information regarding WellCheck dates and times in your area.

Online Registration:

Online registration is required for all participants for WellCheck appointments. To register go to: my.itstartswithme.com.

Lab Tests:

Log on to your It Starts With Me account for a complete listing of tests available at WellCheck.

Flu Shots:

Are offered FREE in the fall, subject to national vaccine availability. Go to Wellness WellCheck for more information.

Healthy Lifestyle Education & Support

Quick Help Program:

If you have a quick question regarding health, fitness, or nutrition related topics, send us an email at: wellness@montana.edu. We will do our best to provide the information you need or point you in the right direction if we don’t have an answer ourselves! The information given through the Quick Help Program does not provide medical advice, is intended for general educational purposes only, and does not always address individual circumstances.

WellBaby Program:

WellBaby is a pregnancy benefit designed to help you achieve a healthier pregnancy. Enroll during your first trimester to take advantage of all of the program benefits. For more information call 406-660-0082 or visit the WellBaby web page.

Stay Connected

For education and updates visit our Blog * Like us on Facebook * Visit the MUS Wellness Website

Wellness Incentive Program:

Discover your own path to wellness with the 2021 Wellness Incentive Program!

Active employees can join exciting new wellness activities that will help you blaze a trail to your best life - all while earning rewards.

When you participate in the MUS wellness incentive program and rack up points, you can move from Scout (1,000 points) up to our fourth level — Expedition (4,060 points) — to earn a Fitbit Health Tracker and gift card rewards.

Ready to discover your own path to wellness? Here's how to get started:

- Login at muswell.limeade.com.

Haven't registered? Click "Activate Account" on muswell.limeade.com and follow the detailed instructions. - Take the Well-Being Assessment: Your assessment helps you understand the many dimensions of your well-being. Plan on spending approximately 15 minutes to complete.

- Complete a WellCheck Health Screening (blood draw and biometric screening) in 2021: Completing a WellCheck health screening will give you an accurate measure of your health so you can maintain your health and prevent disease. View the Wellcheck schedule.

For more information about the MUS Wellness incentive program, please contact the MUS Wellness office at 406-994-6111. For Limeade technical help or problems registering, please contact Limeade Support at 866-885-6940 or email support@limeade.com.

Take Control Lifestyle Management Program:

Take Control is a health coaching program that believes living well is within everyone’s reach. Take Control offers comprehensive and confidential education and support for the medical conditions listed below. Their unique and convenient telephonic delivery method allows Plan members to participate from work or home and receive individual attention specific to each Plan member’s needs. Members with any of the following conditions may enroll:

Take Control Program Offerings:

Diabetes – Type I, Type II, Pre-diabetes, or Gestational (Fasting GLUC > 125)

Weight Loss – High Body Mass Index (BMI > 24.99)

Tobacco User – Smoking, chewing tobacco, cigars, pipe

High Blood Pressure – (Hypertension) (Systolic > 140 or Diastolic > 90)

High Cholesterol – (Hyperlipidemia) (CHOL > 240 or TRIG > 200 or LDL > 150 or HDL < 40M/50F)

WellBaby participants can join Take Control as part of the WellBaby program

Services provided include monthly health coaching, copay waivers for diabetic supplies, monthly blog written by Take Control staff with healthy lifestyle topics and website with additional health resources.

Additional Benefits That Can Be Pre-Authorized by your Health Coach:

Visit with your In-Network primary health care provider (with $0 copay), sleep study (deductible/coinsurance waived), additional counseling visits (with $0 copay).

For details, visit the Take Control program information or contact Take Control at 1-800-746-2970 or visit the Take Control website.

EAP and Work-Life Services (optional)

The EAP Can Help with Almost Any Issue

EAP benefits are available to all employees and their families at NO COST to you. Help is just a phone call away. The EAP offers confidential advice, support, and practical solutions to real-life issues. You can access these confidential services by calling the toll-free number and speaking with a consultant.

EAP Services for Employees and Families

- 24-hour Crisis Help: toll-free access for you or a family member experiencing a crisis.

- In-person Counseling: up to 6 face-to-face counseling sessions for relationship and family issues, stress, anxiety, and other common challenges.

- RBH eAccess: convenient access to online consultations with licensed counselors.

Online Resources at ibhsolutions.com

ibhsolutions.com: the EAP includes access to online tools and educational resources to help make life easier.

Monthly newsletters

Wellness resources assessments

Self-directed course articles

Healthy recipes

Current health news + movies

Legal resources

Retirement planning resources

Access Counseling and Benefit Information

CALL: 866-750-1327

- Select Members from the top right corner

- Click on the RBH logo

- Enter your Access Code: MUS

- Click the My Benefits button

Flexible Spending Accounts (optional)

Administered by

WageWorks

1-877-WageWorks (1-877-924-3967)

Temporary Changes – The Consolidated Appropriations Act, 2021 allows the MUS to temporarily amend the HCFSA, LPFSA, and DCFSA to provide enhanced benefits for a limited time. This means that unused funds from HCFSA, LPFSA, and DCFSA from FY2020 (July 1, 2019 – June 30, 2020) from Allegiance Flex Advantage and from FY2021 (July 1, 2020 - June 30, 2021) from WageWorks will be rolled over to the new benefit plan year that begins July 1, 2021 (FY2022). The rollover for FY2022 is only applicable for active MUS benefits eligible members and does not include employees who have terminated employment with MUS.

Rollover Funds

Be sure not to elect more than you will need to cover expenses incurred by you and/or your family members during the benefit plan year. Under the “use it – or – lose it” rule, any money not used by the end of the benefit plan year will be forfeited. The IRS permits health FSAs to allow rollover from one benefit plan year to the next.

Important Reminders:

If an employee does not enroll in an FSA for FY2022 and has unused FSA funds in the amount of $50 or less that are not expended by June 30, 2022, the FSA will be closed and the remaining unused funds will be forfeited. Claims must be received by WageWorks by September 30, 2022 for reimbursement.

No Automatic Enrollment: You must re-enroll each benefit plan year to participate in a Flexible Spending Account (no exceptions can be made on late enrollment).

Flexible spending account administrative fees will be paid by MUS.

| FSA Account Types | FSA Annual Contribution Amount | FSA Qualifying Expenses |

|---|---|---|

| Health Care FSA | Minimum Contribution: $120 Maximum Contribution: $2,750 |

Medical and Rx expenses, including but not limited to, deductibles, coinsurance, copays, and dental and vision expenses. |

| Limited Purpose FSA | Minimum Contribution: $120 Maximum Contribution: $2,750 |

Dental and Vision expenses only, including but not limited to, dental exams, dentures, contacts, eyeglass frames and lenses. |

| Dependent Care FSA | Minimum Contribution: $120 Maximum Contribution: $5,000 |

Costs for day care provided to your dependent child(ren) under age 14, or other dependents unable to care for themselves, and is necessary for you to remain employed. |

Health Care Flexible Spending Account (HCFSA)

During the annual enrollment period, you may elect amounts to be withheld from your earnings to pay for your Out-of-Pocket medical, dental, and/or vision expenses.

HCFSA expenses which are eligible for reimbursement include those defined by IRS Code, Section 213(d).

Comprehensive list of HCFSA eligible expenses (includes a list of expenses that may require a letter of Medical Necessity signed by your doctor or a prescription from your doctor)

If you or your legal spouse contribute to a Health Savings Account (HSA), you are not eligible to participate in a general purpose HCFSA. However, you may enroll in a Limited Purpose Flexible Spending Account (LPFSA).

Limited Purpose Flexible Spending Account (LPFSA)

The LPFSA guidelines are the same as the HCFSA, with the exception of eligible expenses. The LPFSA eligible expenses only include dental and vision expenses. Comprehensive list of eligible LPFSA expenses.

When you enroll in the HCFSA or LPFSA, you are electing to participate for the entire benefit plan year. No changes to your FSA election may be made during the benefit plan year unless you experience a “qualifying event”. Changes must be consistent with the change in status or qualifying event.

Your FSA will reimburse you for eligible expenses that you, your legal spouse, and your qualified dependents incur during the benefit plan year. The annual amount you elect will be available on July 1st and can be used at any time during the benefit plan year.

The amount you elect for your HCFSA or LPFSA expenses are not subject to federal, state, Social Security, or Medicare taxes. View the tax savings FSA calculators for accurate savings estimates.

Dependent Care Flexible Spending Account (DCFSA)

If both you and your legal spouse work or you are a single parent, you may have dependent day care expenses. The Federal Child Care Tax Credit is available to taxpayers to help offset dependent day care expenses. A DCFSA often gives employees a better tax benefit. You should consult your tax preparer to determine which option works best for you.

Your DCFSA lets you use “before-tax” dollars to pay day care expenses for children under age 14, or individuals unable to care for themselves. A dependent receiving day care must live in your home at least eight (8) hours per day. The day care must be necessary for you and your legal spouse to remain gainfully employed. Day care may be provided through live-in care, babysitters, licensed day care/preschool centers, and after school care. You cannot use “before-tax” dollars to pay your legal spouse or one of your children under the age of nineteen (19) for providing day care. Schooling expenses at the kindergarten level and above, overnight camps, and nursing home care are not reimbursable.

Unlike health FSAs, DCFSAs may only reimburse expenses up to the amount you have contributed at any time during the benefit plan year. If you submit a reimbursement request for an amount that is greater than your account balance, that amount will be pended until your next contribution is posted to your account and then any eligible amount(s) will be reimbursed to you.

Reimbursement Options

Claims are normally processed within 2 – 3 business days of receipt and you should have a check in your mailbox or a direct deposit (if applicable) within 5 business days after WageWorks receives your claim. You may mail (WageWorks, PO Box 14053, Lexington, KY, 40512), fax toll-free (877-353-9236), or scan and send claims electronically or via your mobile device.

Pay Me Back or Pay My Provider:

When filing a request for reimbursement, you may elect to have WageWorks make the payment directly to you (Pay Me Back) or to pay your provider directly (Pay My Provider). You may also elect to have recurring payments for weekly DCFSA expenses or recurring medical expenses such as orthodontic claims.

Direct Deposit:

When submitting Pay Me Back reimbursement requests, you may elect to receive your reimbursement via check or direct deposit. Sign up online for direct deposit at www.wageworks.com and WageWorks will electronically deposit reimbursements directly into your checking account.

Healthcare Debit Card:

WageWorks sends debit cards as part of the HCFSA and LPFSA. You may request a Healthcare Debit Card(s), at no cost, by calling WageWorks or requesting online. You may use the Healthcare Debit Card to pay for eligible medical, dental or vision care expenses. Documentation for the expense may be required so it’s a good rule of thumb to keep all receipts, Explanation of Benefits (EOB), and other supporting documentation when you use your Healthcare Debit Card.

The WageWorks Healthcare© Card is the quick and easy way to pay for eligible HCFSA and LPFSA expenses. You can also request reimbursement on a mobile device, by submitting an online claim, by toll-free fax, or through the mail. If the expense is normally covered by your medical, dental, or vision hardware coverage, you must provide the Explanation of Benefits (EOB) as documentation to support your request. If your Medical, Dental, or Vision Hardware Plan coverage will not cover the expense, an itemized statement from the provider will satisfy documentation requirements.

To be eligible for reimbursement: All claims must be received by WageWorks by September 30, 2022.

Have funds you need to spend before the end of the benefit plan year? WageWorks partners with FSA Store, an online marketplace which has a large selection of eligible HCFSA and LPFSA products. You can use your Healthcare Debit Card to conveniently order and pay for these products online!

All claims for eligible expenses that were incurred during FY2020 (July 1, 2019 – June 30, 2020) and FY2021 (July 1, 2020 - June 30, 2021) benefit plan years must be received by WageWorks by September 30, 2022, to be eligible for reimbursement. If you terminate employment during the benefit plan year, your participation in the plan ends, subject to COBRA limitations. However, you still may submit claims through September 30, 2022, if the claims were incurred during your period of employment, and during the benefit plan year. No exceptions can be made on late claims submissions.

Mid-Year Election Changes

Mid-year FSA election changes must be made within 63 days of a qualifying event. Changes are limited and differ for each pre-tax option. Changes must be consistent with the change in status or qualifying event. For more information about mid-year election changes, please contact your campus Human Resources/Benefits Office.

FSA Questions?

Contact your campus Human Resources/Benefits Office or WageWorks.

WageWorks Customer Service is available 24 hours a day / 7 days a week. Call 1-877-WageWorks (1-877-924-3967) or use the Live Chat function within the participant portal.

Supplemental Life Insurance (optional)

Administered by

Standard Life Insurance

1-800-759-8702

Optional Supplemental Life Insurance:

This is an Employee only benefit. If you enroll for Optional Supplemental Life Insurance, your cost depends on your age as of July 1st and the amount of coverage you select, as shown in the following table. The cost of this benefit is paid on an after-tax basis.

- If you are a new employee, you may elect up to $300,000 in coverage during initial enrollment without submitting evidence of insurability.

- If a new hire elects $0 in coverage during their initial enrollment, they can add coverage of $25,000 at annual enrollment. If they want to elect more than $25,000 at annual enrollment, they are required to submit evidence of insurability.

- If you are not enrolling for the first time, you may increase one level of coverage during annual enrollment (up to $300,000) without having to submit evidence of insurability. You may also increase coverage more than one level; however, you will need to submit evidence of insurability for the increase above more than one level.

- Elections above $300,000 will always require evidence of insurability.

- An employee may decrease their coverage to any level or drop coverage completely during annual enrollment.

- An employee may increase or decrease their coverage one level or drop completely due to a qualifying event, as long as the change is consistent with the event (such as, a dependent is disenrolled, coverage can be decreased one level).

“The controlling provisions will be in the group policy issued by Standard Insurance Company. Neither the certificate nor the information presented in this booklet modifies the group policy or the insurance coverage in any way.”

Optional Supplemental Life Monthly Rates (after-tax)- Employee Benefit

(based on age of Employee as of July 1st)

| Age | $25,000 | $50,000 | $75,000 | $100,000 | $125,000 | $150,000 | $175,000 | $200,000 | $225,000 | $250,000 | $275,000 | $300,000 |

|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Under 30 | $1.50 | $3.00 | $4.50 | $6.00 | $7.50 | $9.00 | $10.50 | $12.00 | $13.50 | $15.00 | $16.50 | $18.00 |

| 30 - 34 | $2.00 | $4.00 | $6.00 | $8.00 | $10.00 | $12.00 | $14.00 | $16.00 | $18.00 | $20.00 | $22.00 | $24.00 |

| 35 - 39 | $2.25 | $4.50 | $6.75 | $9.00 | $11.25 | $13.50 | $15.75 | $18.00 | $20.25 | $22.50 | $24.75 | $27.00 |

| 40 - 44 | $2.50 | $5.00 | $7.50 | $10.00 | $12.50 | $15.00 | $17.50 | $20.00 | $22.50 | $25.00 | $27.50 | $30.00 |

| 45 - 49 | $4.50 | $9.00 | $13.50 | $18.00 | $22.50 | $27.00 | $31.50 | $36.00 | $40.50 | $45.00 | $49.50 | $54.00 |